Celebrities

Real estate mogul Grant Cardone says he’d be embarrassed as a husband, father, and human being if he only made $400K per year: 3 clear ways to boost your income now

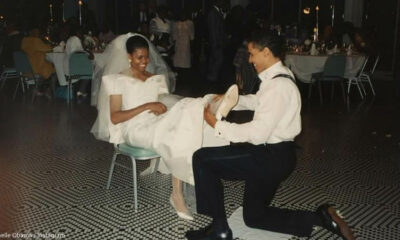

Michelle Obama and her spouse, Barack Obama, share a relationship that has become the epitome of...

Hollywood star Nicole Kidman has recently shared her struggles with height insecurities during the nascent stage...

In a candid conversation on the Go Love Yourself podcast, Katie Price delved deep into the...

In an unsettling turn of events in a Chicago suburb, ex-NFL player Sergio Brown, 35, has...

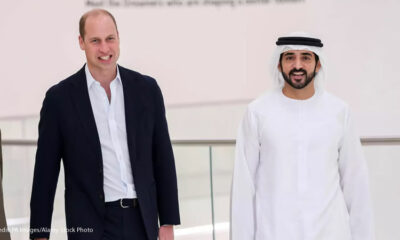

In a recent display of royal etiquette and grace, Prince William, the Duke of Cambridge, has...

Meghan Markle was accused of excessively displaying her wealth as she turned up to Prince Harry’s...

In a resurfaced viral video, Kate Middleton found herself in the spotlight alongside Hollywood superstar Tom...

Oscar-winning actor Jamie Foxx has made his first public appearance since his hospitalization in April 2023...

The Duke of Sussex, Prince Harry, has submitted a bid to the High Court to reference...

On June 14, former President Donald Trump marked his 77th birthday in the familiar setting of...

Prince Harry and Meghan Markle’s Spotify deal ends, sparking rumors about their Netflix partnership, but signs...

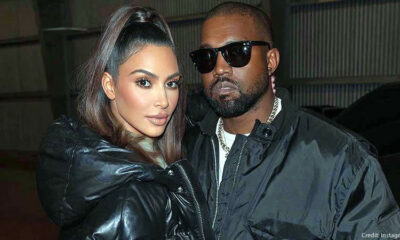

In a surprising turn of events, Kanye West, also known as “Ye,” has developed an apparent...

Graydon Carter, the former editor-in-chief of Vanity Fair, has spoken out regarding Prince Harry and Meghan...

Chrissy Teigen is here to bring you your daily dose of joy! The mother of three...

Since the release of Prince Harry‘s controversial memoir Spare, it seems like another issue has popped...

Colorado Representative Lauren Boebert has rejected claims that she is dating right-wing Christian country artist Sean...

Barack Obama responds to Michelle Obama‘s previous claims that she ‘couldn’t stand’ him for the first...

Janet Jackson fans were surprised by an unexpected special visitor in the audience at the PNC...

Is Adidas making a comeback? It’s difficult to say, given that the CEO forecasts a “bumpy...

Justin Bieber‘s fans are rallying around him after a new Coachella video surfaced online last week....

Morgan Freeman, in a rare interview, revealed his distaste for both the idea of ‘Black History...

Brad Pitt recently told GQ that he feels he has built a false picture of himself:...

Terry Sanderson may be compelled to pay Gwyneth Paltrow’s legal expenses after she prevailed against him...

Khloe Kardashian and Tristan Thompson have broken up. Fans have speculated for weeks that Kardashian is...

Needless to say, Fred Armisen is not a convincing body double. “Wednesday” co-stars Jenna Ortega and Fred Armisen discovered they’re...

Alec Baldwin sued by three ‘Rust’ crew members for ‘blast injuries’ during shooting: “She watched in...

From William Hung and Larry “Pants on the Ground” Platt’s viral auditions to Kara DioGuardi’s finale-night...

When it came time to start preparing for King Charles’ Coronation on May 6—and the concert...

Jenna Bush Hager has been a fixture in the American news media for more than a...

Marc Anthony and his wife, Nadia Ferreira, have announced the birth of their first child together,...

Sunday’s Super Bowl ended in controversy when Eagles CB James Bradberry was called for holding with...

The long-awaited Super Bowl finally took place yesterday (February 12) and created quite a stir. There...

Chrishell Stause is recovering after ovarian cyst removal surgery. The 41-year-old Selling Sunset star announced the...

After her divorce, Emily Ratajkowski kept her wedding ring. On Monday’s episode of her podcast High...

A short video of Ben Affleck, who has previously talked about his alcohol addiction, protesting to...

Pamela Anderson claims Sylvester Stallone once promised to give her a house and a fancy car,...

Paris Hilton’s mother, Kathy Hilton, has revealed her daughter’s inability to conceive, but the celebrity has...

During a beach outing with suspected new girlfriend Chase Sui Wonders, Pete Davidson said he removed...

Stars have arrived on Graceland to bid Lisa Marie Presley farewell. After a memorial service, the...

Tom Hanks made a big impression as a guest star on Happy Days. So much so...

Shakira “worked out” that her ex Gerard Pique was cheating after seeing her strawberry jam eaten...

Todd and Julie Chrisley are about to start their respective sentences. Todd and Julie Chrisley went...

Lisa Marie Presley’s three surviving children will inherit Graceland, her father’s renowned Memphis, Tennessee mansion purchased...

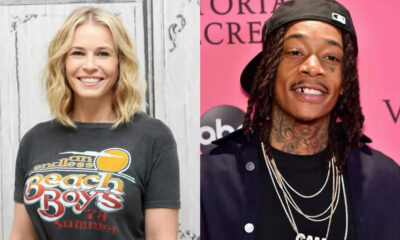

Chelsea Handler, the comedian, has recently expressed her desire to host a late-night show again. And...

Iggy Azalea is teasing new content that will only be available on OnlyFans. The Grammy Award...

Steve Harvey seemed to be juggling a lot recently, between preparing for a new season of...

With Daniel Craig’s latest film, Glass Onion: A Knives Out Mystery, releasing on Netflix over the...

Jason Trawick, the Hollywood agent who was engaged to Britney Spears and briefly worked as her...

Emily Ratajkowski, a model and actress, has pulled American TV celebrity Ellen DeGeneres back into the...

Bad Bunny responded after a video surfaced of him grabbing and throwing a fan’s phone in...

Gabrielle Union is now happily married to Dwyane Wade, and she has always been open about...

Kylie Jenner and Tyga’s tumultuous relationship has been going on for almost a decade, but Kardashian...

Fans think Sandra Bullock let Jesse James get away with far too much. Although Hollywood is...

What happens when design powerhouse Jake Arnold teams up with LA fashion diva Chrissy Teigen? You...

Jeremy Clarkson opened a can of royal whoop-ass for his comments on Meghan Markle in a...

Debbie Gibson has a soft place for Britney Spears, another former teen music sensation. The “Only...

Christmas at Sandringham will be a little different this year: aside from the most visible change...

The Grey’s Anatomy star still looks amazing. Patrick Dempsey earned a cult following for his role...

Kanye West has been barred from another social media site for violating their hate speech policies...

Ben Affleck is speaking up about his divorce from Jennifer Garner. The Last Duel actor went...

Meghan Markle made her television debut before becoming a royal duchess, appearing in the drama series...

Kim Kardashian has spoken out about the latest Balenciaga commercial fiasco. “I have been quiet for...

Khloe Kardashian shows off her baby son to her sisters in the last episode of The...

When you have to go, you have to go – and no one understands this better...

Brooke Shields claims she felt “taken advantage of” during an interview with Barbara Walters in 1981....

Alicia Mccarvell is responding to negative remarks she has received online. On Monday, the Canadian influencer...

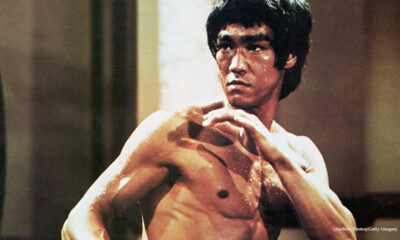

Bruce Lee’s death occurred over 50 years ago. On July 20, 1973, the actor and martial...

Don’t bother putting “happy family images of Prince Harry and Meghan Markle spending Christmas with the...

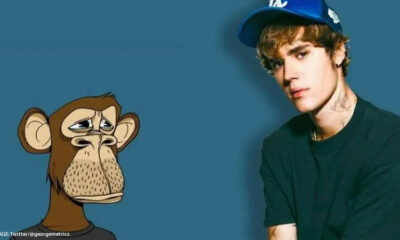

The hype around the Bored Ape Yacht Club was in full force earlier this year when...

Dwayne Johnson believes that growing older is all about achieving balance. The Black Adam star, 50,...

Jenifer Lewis, the self-proclaimed “Mother of Black Hollywood,” is recognized for her audaciously honest voice as...

Taylor Lautner and his long-term girlfriend Taylor Dome married on November 11, one year after getting...

“According to a company-wide email we received this morning, he’s dead to us,” Bowen Yang’s “Brian...

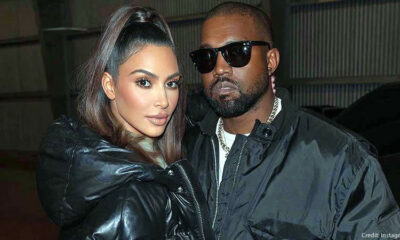

Kanye West attempted to reconcile with his ex-wife Kim Kardashian for some time after she filed...

Jennifer Aniston has denied claims about what caused her marriage to Brad Pitt to end. During...

Tiffany Trump’s wedding in Palm Beach, Fla., scheduled for this weekend, is under threat from a...

Harry doesn’t want the show dropping before Christmas, period. Update on Meghan Markle and Prince Harry’s upcoming...

Amy Schumer called out Ye, the rapper formerly known as Kanye West, for his antisemitic remarks...

Pete Davidson has recently made headlines, primarily because the Saturday Night Live alum is working on...

Mariah Carey is one of an increasing number of musicians who own their masters. With Halloween...

Kylie Jenner celebrated Halloween with her two children in Los Angeles, her boyfriend was partying until...

Spare, a 416-page book published by Penguin Random House, was billed as a work of “raw,...

Kanye West’s disturbing anti-Semitic remarks have caused the fashion industry to distance itself from him. Adidas...

“I just feel like it will come around again” Michael J. Fox, the star of Back...

King Charles III vowed to simplify the British monarchy before he was crowned Sovereign. In interviews...

Sophia Grace Brownlee, the influencer who first appeared on The Ellen DeGeneres Show when she was...

Blake Lively was looking stunning in New York City last night, attending Michael Kors’ New York...

Kanye West must be canceled now if he hasn’t already been. Kanye has turned into a dangerous...

Friends of Tom Brady and Gisele Bündchen are upset with his behavior in the midst of...

Queen Elizabeth II did not want to ‘rush’ the response to the Duke and Duchess of...

In a new TikTok video, Madonna allegedly comes out as gay. The news comes just weeks...

In a now-removed post, Ye, formerly known as Kanye West, published an alleged interaction with Sean...

Prince Harry left England with his wife, Meghan Markle, and their young child, Archie. Markle and...

The Super Bowl-winning quarterback and the supermodel have been married since 2009. Supermodel Gisele Bündchen and...

Khloé Kardashian promoted the second season of her popular reality series, and Tristan Thompson used social...

Simon Cowell‘s Syco Entertainment has agreed to securitize the Got Talent franchise for $125 million. The...

Scott, a billionaire philanthropist, is the former wife of Amazon founder Jeff Bezos. MacKenzie Scott Divorce:...

Friendly exes? Kanye West and ex-girlfriend Irina Shayk laughed together at the Burberry show during London...

‘Uninvited’ rumors abound about Harry and Meghan, claims Kara Kennedy amid reports of ongoing tensions with...

Kanye West is doing a lot of talking again, so some of his favorite topics came...

The pair have performed at both the Super Bowl and the VMAs since becoming friends again...

Abby De La Rosa got candid about her arrangement with Nick Cannon during a discussion on...

Spears says she wasn’t trying to be critical of anybody else. Christina Aguilera unfollowed Britney Spears...

Prince William and Prince Harry met a crowd on September 10, at Windsor Castle and inspected...

Both the Trump team and DOJ submitted two names for the special master position. The DOJ...

Following the death of Queen Elizabeth II, all eyes have been focused on a few notable...

The Duke of Sussex remembered his grandmother fondly in the heartwarming note. Following the death of...

Tom Brady will take the field for his first NFL game after his retirement on Sunday...

“It also brought my sister, Annie, Susie, and Nancy, closer to me than I ever thought...

King Charles III was only formally proclaimed the United Kingdom’s new reigning monarch on Saturday, but...

He dated American model Morrone for four years Leonardo DiCaprio‘s divorce from American model Camila Morrone...

Poulter, one of the more prominent LIV Golf defectors, is among those from the Saudi-backed series...

The actor’s long locks are gone, and he wants to tell you why. If you know...

“Clean Slate,” a new comedy from Norman Lear’s Act III Productions starring Laverne Cox and comedian...

It has been revealed that a new documentary this month would follow Johnny Depp and Amber...

Following the rapper’s online attacks on her and her family, KIM Kardashian has thrown some major...

The couple dined at Cecconi’s in West Hollywood Brooklyn Beckham took to Instagram to dispel rumors...

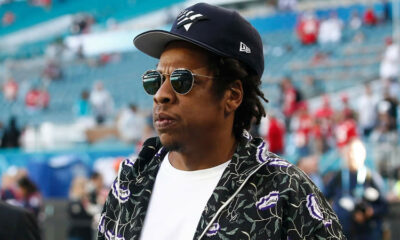

Jay-Z said ‘The Beat’ anchor’s “HOV DID” analysis was needed for “people to articulate and understand...

Kanye West is getting roasted on the internet after posting a photo of Donda Academy students...

At the 79th Venice International Film Festival, Barbara Palvin and Dylan Sprouse were not afraid of...

Taylor Swift announced her 10th studio album, Midnights, will be released on Oct. 21 at the...

Leonardo DiCaprio is back on the market after quietly breaking up with his girlfriend, model Camila...

Hip-hop fans are all aware that Kanye West can be a bit of a live wire...

Dominic Monaghan reflected on his split with Lost co-star Evangeline Lilly during the mid-aughts, telling Anna Faris for...

Did Kim K and Pete Davidson’s break-up impact the kids? Pete Davidson kind of came off...

America’s Got Talent judge was blown away by AI company Metaphysic on season 17 of the...

It’s hog heaven! Exes Bradley Cooper and Irina Shayk spent their tropical vacation with pigs, and...

Wendy Williams, a former talk show host, made an appearance in New York City following her...

Out of stock! Scott Disick and Kimberly Stewart are dating after his divorce from Rebecca Donaldson...

She’s probably a little happier now. Michelle Branch’s domestic assault case has been dismissed, authorities in...

Sylvester Stallone’s wife of 25 years, Jennifer Flavin, filed for divorce on Friday Sylvester Stallone and...

Hillary Clinton has lost yet again, and she can’t blame it on the Electoral College. In...

Rolling Stone UK has named Harry Styles “the new King of Pop,” which has angered fans of...

According to a new report, Olivia Newton-John secretly carried a torch for John Travolta to her...

Speculation that involved “twin flames” Megan Fox and Machine Gun Kelly. Kelly suddenly ending their relationship...

Jolie filed for divorce just days after the flight from France to Los Angeles Details of...

This is so refreshing to see Kylie Jenner has added another filterless celebrity selfie to our ever-growing bank...

Ivana Trump, a popular figure on the New York social scene in the 1970s and 1980s,...

Elon Musk appeared to discourage his former partner, singer Grimes, from having surgery to accomplish pointed...

Britney Spears wants ex-husband Kevin Federline’s toxic behavior to stop. The former dancer, 44, has been...

Rapper A$AP Rocky was slapped with assault and weapons charges on Monday in connection with a...

Ben Affleck and Jennifer Lopez married on July 17 in Las Vegas, Nevada Ben Affleck and...

Although it may not come as a surprise, Nicole Kidman isn’t the only Hollywood actress who...

“We’ve been together for seven years, so when I brought home the mustache she was like,...

Lewis Hamilton, the icon of Formula 1, has piloted race cars to seven world championships, but...

Elon Musk‘s father has stated that the entire Musk family has accomplished “a lot of things...

Katie Holmes reveals the new movie she directed also features her and Tom Cruise’s daughter on...

In a clip from the upcoming Arsenal All or Nothing documentary on Amazon Prime, Mikel Arteta...

The Duke of Sussex warned of a “global assault on democracy and freedom” in a speech...

Victoria Beckham will be seen as Posh Spice once more in a new documentary since she...

Amara Skye, Whoopi Goldberg‘s granddaughter, stated that she tries to always make her grandmother proud, despite...

With more than 15 years passed since the end of “That ’70s Show,” it’s understandable that...

Kelly Clarkson has allegedly been whining about Brandon Blackstock despite her booming career. Kelly Clarkson’s messy...

KARDASHIAN fans are going wild after Kendall Jenner shared a rare unedited video showing off her...

California Highway Patrol said Momoa got out of his car to help the motorcyclist and flagged...

There remains “a bit of a lack of trust.” Meghan Markle allegedly once accused Victoria Beckham...

The British supermodel talks candidly on BBC radio’s Desert Island Discs about her drug use, defending...

Will Smith continues to be among Hollywood’s highest-paid actors despite this year’s scandals, including the Oscars...

Big Brother 24 will incorporate the Festie Bestie’s twist, in which the Houseguests must compete in...

A new book lays bare a tense summer of 2018, just two months after Prince Harry...

After stiffing producers who fronted him millions for Sunday Service and a ‘Donda 2’ listening party,...

Prince Harry sent the same message as Prince William in his UN speech. Monday’s United Nations...

While Khloé Kardashian is expecting her second child with Tristan Thompson amid his paternity controversy with...

This fall, Michelle Obama will release a book called “The Light We Carry” in which she...

The singer is headed to Australia and New Zealand in 2023 Elton John’s news that he...

Our hearts go out to his loved ones Only two auditions remain before the live events...

Congrats to Maggie! With the help of Robin Roberts and Amy Robach from Good Morning America,...

While on a summer trip to Sardinia, Italy, Adele was spotted on a romantic boat ride...

Tom Bower is famously critical of his subjects. Many people wanted Meghan Markle and Kate Middleton...

There is no doubt that Prince Charles and the Duchess of Cornwall’s more than 40-year relationship...

“I cannot fathom the stupidity that I have seen here” she fumed on Friday Whoopi Goldberg...

George Clooney was one of Hollywood’s most well-known playboys before getting married. Lisa Snowdon, a model,...

The Royal Family’s last few days have not been nice. The Duchess of Cornwall’s 75th birthday...

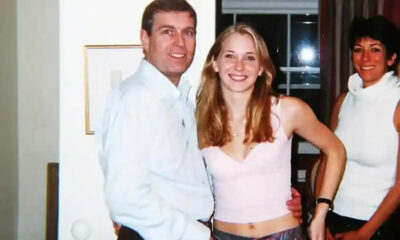

The Duke of York was forced to step up from royal duties after Prince Andrew’s interview...

Christine Hill played an important role in the Duchess’s life The antenatal expert who helped the...

The multifaceted host also paid homage to Richard Pryor and Eddie Murphy. And according to Steve...

Nick Cannon has a long history of relationships. Cannon admits that despite his claim that he...

‘Worth the wait’ Jordan Pickford and Megan Davison have finally had their dream wedding – two...

‘Fooled ‘em all.’ Reggie Bird is extremely exhausted. She recently won Big Brother Australia for a...

Check out one singer’s performance that moved Sofia Vergara to tears! It was the first auditions...

Lizzo expressed her joy after getting her first Emmy nomination. For her series Watch Out For The...

The “Let’s Get Loud” singer remembered “feeling totally normal” Then and there “all of a sudden I...

Prince Harry has been “dragged around like a performing seal” by Meghan Markle, a royal expert...

Unusual, unfounded, but persistent Meghan Markle conspiracy theory The duchess spoke to the issue in a...

Travis Scott shared a photo of his recent dad duties with Kylie Jenner for their son....

Elon Musk, the CEO of Tesla, and Shivon Zilis, a senior executive at his Neuralink neurotechnology...

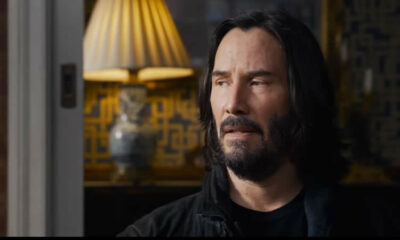

You have to think that Keanu Reeves is a good guy because there seem to be...

The Only Way Is Essex co-star Lauren Goodger and British guy Jake McLean’s ex-girlfriend Lauren McLean...

Danny Moder and Julia Roberts have been married for 20 years, and they are still deeply...

Last week Kelly was sentenced to 30 years in jail for charges of s*xual assault. R....

Convicted sex trafficker’s lawyers claim he’s suffering “severe mental distress” after being put in solitary confinement...

Cameron Diaz is officially out of retirement. The action-comedy “Back in Action” on Netflix will star...

Here is what a security guard for Britney Spears claims happened on her wedding day. Since...

Check out the performer who convinced Heidi Klum to reconsider her AGT golden buzzer decision! There...

Palace Responds to Viral Video of Prince William Confronting Photographer on Family Bike Ride: ‘How Dare...

Ben Rottenborn, the attorney for Depp’s ex-wife, dived into Depp’s feelings about the mega-film franchise during...

Samuel Garner Affleck, son of Hollywood actor Ben Affleck, was left speechless after he carelessly crashed...

Alec Baldwin is no stranger to controversy, and the actor is currently preparing to have an...

Britney Spears‘ legal situation may have improved after the judge decided in November that her 13-year...

Is Kris Jenner, the former Keeping up with the Kardashians alum, running for president in 2024 or are...

The X Factor is reportedly being revived by TV judge Simon Cowell in the hopes that...

When he tried the Beat Ya Feet dance in Washington, D.C., Justin Timberlake wished he could...

The media mogul and Hall’s marriage is ending after six years together, which will be the...

The actor from Once Upon a Time in Hollywood is in a new reckoning. One of...

The Internet once again features the infamous elevator that most likely caused Amber Heard to lose...

when she was a working member of the British royal family was made public this week....

In a video that has reappeared after the release of her latest collaboration with the contentious...

Kim Kardashian was forced to halt her interview on the Tonight Show With Jimmy Fallon on...

More than 36,000 people have signed a petition calling for Whoopi Goldberg to be fired from...

New information is emerging regarding why Prince Harry, Meghan Markle, and their children Archie, 3, and...

According to TMZ, Kim Kardashian and Kanye West were caught together at a basketball game outside...

Michelle Obama urged Americans not to tune out of the country’s deadlocked political system on Monday,...

The national average for a gallon of gas sits at more than $4.98 People who complain...

In early June, Prince Harry and his wife, Meghan Markle, brought their two children to London...

The reactions to Ryan Gosling’s look as Ken in the upcoming Barbie movie are aplenty and...

Tell it how it is! Kim Kardashian shared some advice based on her own experiences with...

Although Brad Pitt and Gwyneth Paltrow’s relationship seemed to have ended a long time ago, their...

Britney Spears has reportedly sacked her security team after her ex Jason Alexander’s shocking disturbance at...

Prince Charles Is Under Pressure To Reverse The Course Of Action About Prince Harry And Meghan...

The Top Gun star and the Marvel actress have had something of an on-off romance over...

When Kim Kardashian learned that Tristan Thompson had cheated on her sister again, this time with...

The Game is revisiting an “awkward” conversation he had with Kanye West earlier this year. The...

U.S. Olympic gymnasts Simone Biles, McKayla Maroney, and Aly Raisman are among 90 women who are...

On Tuesday’s episode of “The View,” Whoopi Goldberg screamed back at conservative guest host Lindsey Granger,...

A British court heard that two white nationalist podcasters stated Prince Harry should be “judicially killed...

If you think you’re out of touch with your family, know that you’re probably doing a...

Wendy Williams, the six-time Emmy-nominated talk show host, has been fighting to regain control of her...

Are you Blake Shelton Gwen Stefani What is the point of growing apart? According to one tabloid, the couple’s...

On Sunday evening, Jennifer Lopez had to wipe away tears as she accepted the MTV Movie...

Kim Kardashian revealed she was just after sex with Pete Davidson but ended up falling in...

Johnny Depp proved all aspects of defamation against Amber Heard after three days of discussion. Damages...

While Coronation Street is known for bringing hot love scenes and shocking storylines to Weatherfield, the...

When she was only 17, the Canadian singer’s debut album wowed the world. Now, as Let...

Her Majesty is known for her love of bright colors and it seems her choice of...

Kaia Gerber desired an “understated” and “comfortable” look for the ‘Elvis premiere. The Vogue cover star,...

Prince Harry and his wife Meghan Markle recently renewed their lease on Frogmore Cottage, and Netflix...

Russia has banned almost 1,000 prominent Americans from visiting the country permanently, in reaction to economic...

Fans were shocked by the ‘Euphoria’ actor’s “unpopular opinion.” Dominic Fike dug his own grave when...

Meghan Markle’s sister has told GB News presenter Dan Wootton that she is “thankful to God”...

Johnny Depp is expected to return to the witness stand on Monday as his defamation trial...

Cave has lost two sons in the space of seven years In the wake of his...

Will Smith says that while tripping on ayahuasca, a herbal drink with psychedelic effects, he saw...

After Prince Harry won a polo tournament in Santa Barbara, California, Meghan Markle congratulated him with...

Isaiah Lee, the 23-year-old guy who attacked comedian Dave Chappelle during his performance, has spoken out...

According to the Los Angeles Times, Jeffrey Cooper, an architect and member of the Academy of...

As white supremacy gains traction in the United States, conservatives dismiss it as fiction while discussing...

A royal who needs to relax. Those close to Queen Elizabeth II have advised her to...

Taylor Hawkins Friends Claim He Expressed Discomfort about Foo Fighters’ Tour Schedule Before He Died: “He...

After Joy Behar announced Whoopi Goldberg would be taking a break from the ABC morning show...

The former First Lady of the United States has given her first interview since leaving the...

Elon Musk wants to meet his Chinese lookalike, a man from the northeastern Chinese province of...

“Losing it crying, losing it laughing – there’s no way, I don’t think, to feel more...

Whoopi Goldberg was suspended from co-hosting The View for two weeks after her controversial on-air take...

Prince Harry and his wife Meghan Markle announced their plans to visit the UK for Queen...

The Duke of Cambridge is alleged to have purposefully avoided meeting his brother on his April...

Travis Scott invited the ladies over to his first public performance following the tragic Astroworld Festival....

In 2022, the couple will celebrate their 30th wedding anniversary. Take a peek at Michelle Obama’s...

Did Prince William Fluchte from the UK Prince Harry‘s visit. One tabloid claims the Duke of Cambridge wanted...

In May 2022, Netflix is adding a Swedish drama miniseries, a war drama movie, new seasons...

Machine Gun Kelly Osbourne and Megan Fox have admitted to consuming each other’s blood for “ritual...

The Duke and Duchess of Sussex signed multimillion-dollar partnerships with Netflix and Spotify to create original...

Elon Musk Says Donald Trump’s Truth Social Is ‘Currently Beating Twitter & TikTok on the Apple...

Her bodyguard was not in a good mood. On TikTok, a video of Paris Hilton’s bodyguard...

Jamil expressed concerns that the deal will bring about further “hate, bigotry, and misogyny” on the...

The ‘Boogie Nights’ actress wore a black bikini in Utah’s famed hot springs Heather Graham is...

I don’t know about you, but one of my major pet peeves is rudeness from celebrities...

“I feel really bad that he never apologized,” Chris Rock’s mother said Chris Rock’s mother, Rose...

After recent cosmetic surgery, Sharon Osbourne was horrified to discover she looked like “f***ing Cyclops.” The...

After walking out of Piers Morgan’s new talk show, Donald Trump has spoken out. It’s only...

Last month, Lady Gaga and Liza Minnelli came together to accept the Best Picture award to...

After learning that Khloe Kardashian was worried about her Late Show appearance due to trolling, James...

Despite going their separate ways, the musician says their time together was ‘amazing.’ Cody Simpson, an...

Duke of Sussex Prince Harry has been praised by royal fans after his “incredibly touching” gesture...

Scott Disick was reportedly in grief after knowing that his ex-girlfriend, Kourtney Kardashian was still in...

Johnny Depp’s $100 million defamation lawsuit conflicts with his former wife, Amber Heard, carry on within...

Meghan Markle and Prince Harry are going to The Netherlands for the Invictus Games this weekend,...

Prince Harry‘s California work-life is integrating with the Invictus Games, which he founded as a working...

In a sneak peek of Gwen Stefani’s outlook on the daytime Ellen DeGeneres Show, the singer...

Sean Penn admits to ‘f***ed up’ after his divorce from ex-wife Leila George was finalized Despite...

In a major editorial blunder, one of Brazil’s leading newspapers stated Queen Elizabeth was dead. The...

In an outcropped clip, Jada Pinkett Smith accepted that she “really didn’t want to get married”...

Chris Rock told he won’t say on the unknown Oscars slap “until I get paid.” “I’m...

One year after Teigen went through a miscarriage, a source told Star that the model is...

Meghan Markle has given a note of reflection as she grieves the loss of a close...

Amy Schumer sat down by Watch What Happens Live With Andy Cohen on Wednesday and shared...

Carpool Karaoke finally gets back on the Late Show with James Corden after taking a pause...

Meghan Markle’s antagonized father Thomas censured her in a new YouTube video. Thomas said that most...

While the 2022 Grammys ceremony was happening at the MGM Grand Garden Arena in Las Vegas...

Mo’Nique, a comedian and actor, has reconciled with director Lee Daniels, putting an end to a...

At the High Court in London, Nehebat Isbilen claims that her business adviser Selman Turk “dishonestly...

Will Smith sent shockwaves across the industry when he slapped Chris Rock at the Oscars on...

“Saturday Night Live” immediately jumped into the week-long Will Smith controversy, mocking how the “Fresh Prince”...

Last year, the couple reunited and are still going strong — with very public PDAs just...

Will Smith refused to leave the Oscars ceremony after slapping presenter Chris Rock, according to Hollywood’s...

The princess is believed to share a closer bond with Prince Harry than with his older...

‘Always good to hear from Liam Payne of Wolverhampton, Netherlands’- viewers baffled by star’s new accent...

Kim Kardashian and Kanye West were spotted out together on the sidelines of their son’s soccer...

“Jada, I love you. G.I. Jane 2, can’t wait to see it,” Chris Rock said at...

Chris Rock, the comedian, has refused to press charges against Will Smith for his attack on...

Carole Middleton, Kate Middleton’s mother, has spoken out about her heartbreaking fear for her daughter’s royal...

What happened just now? The moment from Sunday’s Oscars that everyone is talking about wasn’t Will...

Musk was responding to a Twitter user’s question on whether he would consider building a social...

Prince William has expressed his deep “sorrow” for the horrors of the slave trade and Britain’s...

“North is very opinionated when it comes to what I’m wearing.” Kim Kardashian has stated that...

Last year, Carl Woods was arrested for allegedly attempting to force his way into a house...

Pete Davidson’s mother appears to be keeping up with her son’s romance. See what Amy Waters...

Caitlyn Jenner refuses to recognize Lia Thomas, a transgender swimmer from the University of Pennsylvania, as...

Prince William is said to be angry at Prince Harry for refusing to attend Prince Philip’s...

Since they stepped down as senior royals in 2020, Prince Harry and Meghan Markle have yet...

‘I still don’t know how to answer the question.’ Michael Bublé and his wife Luisana Lopilato...

Daniela Elser, a royal expert, pointed out that the Queen has never given an interview and...

Former England captain David Beckham handed control of his Instagram account to a Ukrainian doctor in...

Lady Pamela Hicks, Queen Elizabeth’s former lady-in-waiting, reflects on being a witness to history. Pamela, Prince...

‘DWTS’ pro-Maksim Chmerkovskiy left Ukraine earlier this month to return to Los Angeles with his wife...

Kim Kardashian also addressed going Instagram official with Pete. Pete Davidson’s new tattoo on his chest...

“It’s not easy mentally, physically, spiritually.” Kylie Jenner has revealed that she has been struggling following...

Camilla the Duchess of Cornwall engaged in a sweet chat with her stepson Prince William in...

In the second part of a new documentary premiering Wednesday on HBO (9 EDT/PDT), Evan Rachel...

Director Jane Campion has apologized to tennis legends Venus and Serena Williams for making “thoughtless” remarks...

Rebel Wilson dared to name out Prince Harry and Meghan Markle’s notorious Oprah Winfrey interview whereas...

Less than two months after announcing his retirement from the NFL, Tom Brady confirmed that he’s...

Traci Braxton, a singer, and actress who stars in the reality show Braxton Family Values with...

The interview has made the Duke and Duchess of Sussex “almost unapproachable from the rest of...

English broadcaster and journalist Piers Morgan will host a prime-time program for TalkTV. In the first...

The co-hosts of “The View” misled viewers on Tuesday by calling Florida’s “Parental Rights in Education...

Following his visit to a rodeo in Texas, Prince Harry was scolded by PETA, an animal...

Antony Starr, a 46-year-old actor, is best known for his portrayal as the main antagonist in...

Sharing a poem about ‘DIVORCE’ on his Instagram days after Kim becomes legally single, the DONDA...

The pair have reportedly been dating since 2019 when they were first spotted together at the...

Prince Harry flew solo over the weekend to visit Fort Worth, Texas. During the Stockyards Championship...

To say the least, Julia Fox’s last few months have been eventful. The Uncut Gems actress...

“Keep it quiet but just come back to help celebrate not just for the Queen but...

JK Rowling has criticized Scotland’s Gender Recognition Reform Bill, claiming that it will “harm the most...

Ashton Kutcher and Mila Kunis are halfway to their $30 million fundraising goal for Ukraine’s citizens....

According to a royal author, Meghan Markle‘s response to Prince Charles’ offer to walk her down...

After a decade of marriage, Prince William is still deeply in love with Kate Middleton—and he...

Excuse me, how cute? Anyone can see that the Duke and Duchess of Cambridge are deeply...

Kanye’s new song ‘Eazy’ is from his upcoming album Donda 2. Kanye West is being criticized...

Pete Davidson made a brief return to Instagram before deactivating again. MEGA Blinked and you missed...

Meghan Markle and Prince Harry’s alleged plan to return to the Royal Family as “part-time royals”...

COPPOLA, MIKE Despite rumors of a reconciliation, Jason Momoa maintains that he and his estranged wife...

Her Majesty was joined by the Duke and Duchess of Cambridge and their three children, as...

On Sunday, Helen Mirren was honored with the SAG Life Achievement Award at the 2022 SAG...

On Sunday night, the actor won the award for Outstanding Performance by a Male Actor in...

“Our lives were brought together for a reason,” the Duke of Sussex said as the couple...

The View hosts have been blasted for making “ridiculous and tone-deaf” comments about the Queen’s COVID-19...

Kanye West used to spend a lot of his now-deleted social media posts savagely criticizing Kim...

Piers Morgan has expressed his desire for Meghan Markle to be the first guest on his...

Camilla Parker Bowles gave her first interview since it was announced she will one day be...

Prince Harry, who is already a plaintiff in a phone-hacking lawsuit against British tabloids, filed a...

Britney Spears claims that her business dealings with Tri-Star Sports & Entertainment were a disaster. Britney...

The cause of death of “General Hospital” actress Lindsey Pearlman has been “deferred, pending additional investigation”...

Prince Harry’s lease on Frogmore Cottage in Windsor has allegedly been renewed, letting him continue serving...

Wendy Williams expresses herself in a video posted on her new Instagram account. A representative for...

The family of “Rust” cinematographer Halyna Hutchins has filed a new lawsuit against actor Alec Baldwin....

Britney Spears and her lawyer, Mathew Rosengart, have been invited to testify before Congress about conservatorships,...

Famous Walmart yodel boy Mason Ramsay is viral again after his 2019 song trends in TikTok...

According to a source, Camilla Parker Bowles does not get along with Meghan Markle. The Duke...

Horwitz, whose screen name was Zach Avery in a few horror films, pleaded guilty to securities...

Princess Diana appeared to be accustomed to the flashbulbs, the gaggle of photographers that followed her...

Hugh Hefner and the depravity that took place at the Playboy Mansion were the subjects of...

Supermodel Naomi Campbell has spoken about her baby daughter in an interview with British Vogue, saying:...

Queen Elizabeth is being closely monitored for COVID-19 after Prince Charles tested positive for it, as...

Ye’s having trouble deciding what to order from the drive-thru Check out Kanye West’s cameo in...

The Duke of Sussex was spotted in the crowd with his cousin Eugenie. Prince Harry is...

The feud between Britney Spears and Jamie Lynn Spears is escalating. In a now-deleted Instagram post,...

Despite a requirement, Katharine McPhee joined Stacey Abrams’ opponents in criticizing her for posing without a...

As the Cambridges prepare for a crucial Commonwealth trip to Jamaica, the Duke of Cambridge arrived...

PRINCE CHARLES enjoys an impressive property portfolio, spending time at Clarence House, Highgrove House, and Birkhall,...

It is said to be “a shame” that the Duchess of Sussex left her royal duties...

Alec Baldwin is back at work four months after a fatal shooting on the set of...

Camilla’s entrance into the royal family was well documented as a difficult period for both Prince...

The radio silence comes just one day after the Queen said that when Prince Charles succeeds...

The rapper made the claim in a series of Instagram posts that have since been deleted...

Bindi Irwin is enjoying precious family moments. The Crikey! on Friday! The It’s the Irwins star...

Bill Maher, the HBO host, defended Whoopi Goldberg after she made comments about the Holocaust earlier...

After an argument with Meghan Markle, Prince Harry revealed he was afraid he would “lose” her....

Employees at The Wendy Williams Show are reportedly dissatisfied with upper management and the show’s current...

Julia Fox understands Kanye West’s current issues with soon-to-be-ex-wife Kim Kardashian, but she remains hopeful that...

Prince Harry, Meghan Markle’s US Mansion Engulfed In Offensive Odour from Nearby Bird Refuge Prince Harry...

When the Duchess of Sussex married Prince Harry in 2018, she raised eyebrows during her wedding...

Meghan McCain has weighed in on the ongoing situation involving Whoopi Goldberg, a former coworker. And...

Tom Cruise isn’t wasting any time now that he’s met his “Mrs. right.” His rumored new...

Meghan McCain has spoken out after her former co-host on The View, Whoopi Goldberg, made controversial...

THE Queen has passed on to Kate, Duchess of Cambridge, two of the royal patronages Prince...

Rumors have it that Adele and her boyfriend, Rich Paul, are having a falling out, and...

The TV star is taking a short break from the ITV daytime show Holly Willoughby has...

The actor joins a number of A-listers who’ve played the iconic superhero over the years, including...

Prince Harry and Meghan – who have an £18 million production deal with the audio streaming...

If you’re wondering how much Prince Harry and Meghan Markle will have to pay in England...

Miss USA 2019 Cheslie Kryst, an attorney who also worked for the TV entertainment show Extra,...

Barry Manilow, the singer-songwriter, has denied rumors that he will join Neil Young in his fight...

Country music legend Dolly Parton has been happily married to husband Carl Thomas Dean for 55...

Kate Middleton may be taking on a new role within the royal family, and the popular...

Tech news site Protocol reported on Wednesday, Elon Musk messaged the owner of a Twitter account...

Is a walk down the aisle for Ben Affleck and Jennifer Lopez in the cards? The...

It is said that the Duke and Duchess of Sussex could pay the royals an early...

Melania Trump started off 2022 by announcing she’d be auctioning off a hat, as well as...

“The whole thing was baffling, tbh.” Viewers tuning in to last night’s Claire Byrne Live on...

Although Prince Harry has traveled across the pond on his own to visit with the members...

In a filing on Monday, Alec Baldwin’s lawyers argued that a lawsuit coming from the “Rust”...

The ‘Toxic’ singer shared a steamy video on Instagram to highlight how much weight she’s lost...

Last year, the comedian/actor was chastised for using a “blaccent” in one of her roles. Her...

Does Tom Selleck Envy of Mark Harmon? With the NCIS leader settling into retirement, Selleck has...

Meanwhile, more than 900 people have signed a Change.org petition that is calling for Andrew’s dukedom...

Is Kim Kardashian fed up with her cash-hungry mother, Kris Jenner, meddling in her son’s new...

PRINCE HARRY’s judicial review over his security arrangements may expose details about the security structure of...

Whoopi Goldberg was happy to see Maya Angelou’s picture in the United States quarter. However, she...

The royal saga goes on. Despite the Prince of Wales’ recent invitation for the Duke and...

The Dukes of York and Sussex will not obtain Jubilee medals like other members of the...

Christine Brown, actress, and legendary R&B singer-songwriter Chris Brown’s aunt, keeps it taste-temptingly real in the...

Meghan Markle will most likely NOT return to the UK as Prince Harry’s police protection row...

“The monarchy is in desperate need of reassuringly conventional royal performers” just like the Duchess of...

Jordan Cashmyer, a 26-year-old woman featured on the documentary series 16 and Pregnant, has died. Jordan...

Prince Harry seems to be very interested in returning to the United Kingdom with his wife,...

On The View, Whoopi Goldberg bashed NBC anchor Craig Melvin for asking Vice President Kamala Harris...

The Duke and Duchess of Sussex welcomed their daughter Lilibet Diana on June 4, 2021. Royal...

Amal Clooney and George Clooney have been married for nearly eight years. Despite the fact that...

Is Queen Elizabeth moving to Kensington Palace with Prince William and Kate Middleton? According to one...

Kate Middleton is, allegedly, ready to retaliate if Prince Harry drags her into his memoir. Kate...

Bob Saget, who played Danny Tanner in Full House, has died. He was 65 years old....

Carolyn Andriano, a key witness in the trial of Epstein associate Ghislaine Maxwell, waived her right...

Queen Elizabeth II will be asked to help Prince Andrew financially if he agrees to a...

In October last year, the actor was holding a gun during rehearsals on the set of...

An Uber driver went above and beyond when he was stranded for hours on Interstate 95...

Meanwhile, a source close to accuser Virginia Giuffre claimed that Andrew could have avoided the lawsuit...

Suni Lee is opening up about her new relationship after making her relationship with her boyfriend...

When Prince Harry and Meghan Markle returned to the United States in July 2020 after a...

In June 2022, Queen Elizabeth II will celebrate her 70th year as the British monarch with...

After a few of her Instagram followers were confused, Halle Berry had to deny that she...

KATE MIDDLETON has had to “step up her game” for the future of the monarchy after...

Whoever Prince Harry dates will almost certainly receive widespread media coverage, as both he and Meghan...

Whoopi Goldberg appeared indifferent as she listened to Meghan McCain rave about the Duchess of Sussex.To...

Candace Owens, a well-known conservative pundit, went toe-to-toe with Meghan McCain of The View on Twitter...

Jada Pinkett Smith, a US actress, has joked that she will adorn her bald patch with...

The Duchess of Sussex receives praise for her “intelligence, analytical mind, and educational pedigree.” According to...

The Duchess of Sussex and the Mail on Sunday newspaper have reached an agreement on “financial...

Not only royal fans but also the singer Kate Middleton accompanied praised Kate Middleton’s first-ever public...

‘At its heart, wokeness is divisive, exclusionary, and hateful… ‘ Elon Musk, the CEO of Tesla,...

Another Royal Replicated Kate Middleton’s Christmas Look Three Years Later. Princess Madeleine of Sweden recently twinned...

‘Someone is responsible for what happened, and I can’t say who that is, but I know...

According to sources inside the Palace, the Queen wants Prince William to be put on a...

Sarah Ferguson said, “I love to see that little boy that cried at the funeral to...

Tristan Thompson has spoken out about his relationship with Maralee Nichols, who is suing him for...

Ingo Rademacher, a former cast member of “General Hospital,” has sued ABC after being sacked for...

Ben Affleck has been criticized for claiming that he felt “trapped” in his marriage to Jennifer...

Jennifer Lopez and Ben Affleck fighting over bad habits? According to one report, Jolie is fed...

Meghan Markle is involved in a slew of controversies. Despite the fact that she is leaving...

The investigation is expected to include the two PAs who allegedly quit due to bullying. In...

A short gathering on the grounds of Windsor Castle is planned for the queen to convey...

Meghan McCain got a reality check on Wednesday after launching a not-so-hot take on the Fox...

On the December 2 episode of ‘The View,’ Whoopi Goldberg expressed her outrage at Supreme Court members who...

At the Kennedy Center Honors on Sunday, President Joe Biden celebrated artists such as Bette Midler,...

A British court rejected an appeal by a newspaper publisher seeking to overturn an earlier ruling...

You are on a mission to help the homeless population in Los Angeles, meet with charities,...

Because of Ben Affleck’s past with alcohol addiction, George Clooney told The Times of London that...

According to a new book, Prince Harry and Prince William once had a strong bond, but...

Kanye West has expressed a desire to reconcile with Kim Kardashian despite their ongoing divorce. On...

It is difficult, confusing, terrifying, and heartbreaking to witness the death of a loved one. They...

After learning that the BBC will air a program saying the princes fabricated accusations against each...

During the ITV special featuring Adele on Sunday, the audience couldn’t get enough of actress Emma...

It’s difficult to believe that David Bowie died nearly six years ago. One of the most...

Meghan Markle stole the show with a surprise red carpet appearance on the arm of her...

According to a report, Wendy Williams is not expected to return to her talk show this...

The highly anticipated film Spencer, featuring Kristen Stewart as Princess Diana, has it all: William and...

The billionaire musician and entrepreneur, known as “Ye”, sat down for a freewheeling conversation on the...

Celebrity Cher, 75, singer, had a huge breakdown on Twitter in response to Democrats’ massive setbacks...

Tom Hanks was given a ticket on a Blue Origin space journey by Jeff Bezos, but...

Aaron Korsh, the creator of SUITS, has opened up about working with Meghan Markle. Before marrying...

Meghan Markle and Prince Harry are contributing to the fight against climate change. The Archewell organization,...

Engagement rumors of Kylie Jenner and Travis Scott are in the Air. Jenner was seen wearing...

The news comes just over a month after the singer won a long battle to be...

Prince Harry is panicked that he won’t be able to be closer to his grandmother while...

For this year’s Halloween, supermodel Hailey Bieber channeled her inner femme fatale by recreating four of...

Prince William isn’t the only member of his family who is concerned about the environment. Prince...

“As soon as she’s ready, she will be back in her treasured purple chair.” Wendy Williams’...

Prince William is “no fan” of his uncle Andrew. According to recent news reports, Prince William...

Kylie Jenner and Travis Scott allegedly had a massive argument, just days after finding out that...

HBO Max has released a new video clip and gave fans a first glimpse at the...

Shannen Doherty won a lawsuit over her fire-damaged home and has been awarded $6.3 million. The...

Omarion and Lil Fizz are making amends. On Friday, the B2K members took the stage at...

Bradley Walsh, a former Doctor Who star and Chase favorite, has a new look these days,...

Apple Studios has signed a deal with Spider-Man director Jon Watts to write and direct an...

Hugh Jackman was rumored to be replacing Pierce Brosnan as the 007 prodigy. This was even...

Brian Laundrie’s parents are unaware of their son’s whereabouts, as per the family’s attorney. Attorney Steve...

Jamie Spears, Britney’s father, has been accused by her legal team of breaching “unfathomable lines” by...

Gabby Petito’s family invited the public to a funeral for their daughter on Sunday afternoon, as...

Conor McGregor has responded to taunts about his awful pitch during a baseball game against the...

Nicki Minaj’s husband, Kenneth Petty has been accused of rape by a woman. The woman who...

Lilibet and Archie Harrison might thrill the Queen and Prince Charles by visiting the UK with...

Hollywood star Johnny Depp was awarded a lifetime achievement award on Wednesday at the San Sebastián...

“The KCKPD has failed to provide accountability for officer misconduct,” according to the lawsuit. Jay-Z is...

On Monday morning, South Korea’s BTS left it all on the floor – the floor of...

Sarah Dash, a well-known singer and founding member of the R&B girl group Labelle, has died....

Emmys 2021 host Cedric the Entertainer couldn’t resist poking fun at the Royal Family as he...

After a cracking year of brilliant TV shows, the time has come to present the best...

Former California Governor Arnold Schwarzenegger said that California “made the right decision” in not recalling Governor...

‘It’s quite an uncomfortable atmosphere,’ Sheeran said The English singer and songwriter Ed Sheeran wasn’t hesitant...

Faith No More and Mr. Bungle have both canceled forthcoming gigs, with frontman Mike Patton claiming...

Kim Kardashian West arrived in New York City on Saturday wearing an all-black leather ensemble. The...

Pierce Brosnan, perhaps best known for his tenure as James Bond 007, is set to join...

Fans can expect to see white rabbits, an exploding train, a plastic duck, lots of code...

The ‘Gods of Egypt’ actor Gerard Butler confessed to injuring three people, unintentionally, in one day...

Much has changed in the last year and a half since the COVID-19 pandemic began, but...

James Spears’ petition to Los Angeles County Superior Court, says his daughter “is entitled to have...

Monica Lewinsky previously expressed a need for “resolution” with Bill Clinton following his impeachment, but she...

Michael K. Williams, who played Omar Little in “The Wire” and Chalky White in “Boardwalk Empire,”...

Comedian Fuquan Johnson and two others died after allegedly overdosing on cocaine laced with fentanyl at...

‘Baby one more Time’ Singer Britney Spears, the 39-year-old pop star, and Sam, 27, have been...

Daffney Unger, a former women’s professional wrestler, died one day after posting alarming social media videos....

Aunt Becky may be making trips to the dance hall after keeping low amid the fallout...

Gregg Leakes, the husband of former Real Housewives of Atlanta star NeNe Leakes, has died following...

Michael Jackson’s brother Tito has indicated that the late pop star’s family may be releasing new...

The ‘All Falls Down’ rapper has issued a brief statement accusing Universal Music Group of releasing...

Jennifer Lopez and Ben Affleck are no longer playing shy when it comes to PDA. On...

German-American actress Diane Kruger and Norman Reedus have reportedly taken a big step in their relationship....

Jeffrey Epstein-accuser Virginia Giuffre has filed a lawsuit against Prince Andrew, claiming that it was “past...

After four years of marriage, Survivor winner Parvati Shallow has filed for divorce from her husband,...

Kanye West has filed a petition to legally change his name to “YE,” according to legal...

After a trial separation, Sonya Curry, the mother of Warriors player Stephen Curry, reportedly filed for...

On Kobe Bryant’s 43rd birthday, Vanessa Bryant expressed her love for him. Vanessa, 39-year-old, wrote on Instagram on...

American actor and comedian Eric Stonestreet disclosed his engagement to fiancée Lindsay Schweitzer in a typically...

Britney Spears is being investigated for misdemeanor battery after an employee said she was struck by...

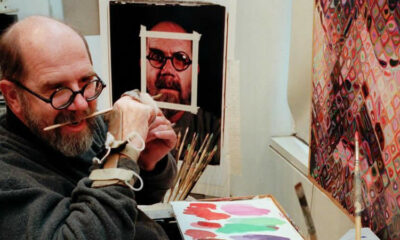

Chuck Close, a photographer, painter, and printmaker best known for his monumental grid portraits and photo-based...

Singer and actress Britney Spears‘ boyfriend Sam Asghari are hopeful the pop icon will perform again....

The season seven premiere of Bachelor in Paradise sets a record-breaking number of hookups, including cameos...

Heidi Montag and her husband, Spencer Pratt, are hoping to have a second child after undergoing...

Kanye West exudes confidence, and Kim Kardashian claims that he has transferred part of it onto...

Rapper and songwriter Machine Gun Kelly showed off a new look when he shared a picture...

The birthday of one of the few genres recognized and celebrated around the world is on...

Dolly Parton announced this week that she will co-author her first novel and release an album...

Jennifer Aniston always maintained that she and her ex-husband, Justin Theroux, have a close connection and...

The actor, 48, is set to voice the role, a red Echidna who is the Master...

After Bravo canceled Kim Zolciak’s long-running reality show “Don’t Be Tardy“ in May, the former “Real...

Blake Lively and Ryan Reynolds have been married for almost nine years. Several tabloids, however, continue...

Meghan Markle mocked Queen Elizabeth II in her birthday video with her friend Melissa McCarthy, according...

The 58-year-old Grand Tour presenter became the latest celebrity to criticize the erstwhile royals in a...

Brody informed Kaitlynn he only wanted to make sure she was “with the right person” after...

The 25 years old model, Sasha Attwood, says social media is “toxic” and it is “really...

The 21-year-old daughter of Reese Witherspoon and Ryan Philip Ave appears to be on her way...

Prince Charles is said to be ‘totally disappointed’ with Prince Harry as a result of his...

Prince Harry escaped from England and he has a new incentive to return. Sussex has recently...

Britney Spears and her boyfriend, Sam Asghari, are considering moving to Hawaii – according to Globe....

Tom Cruise, the star of Mission Impossible, planned a fantastic surprise for Hayley Atwell. The Hollywood...

Sussexes were said to be given a choice that they could have made their relationship better...

Yesterday, we reported that former first lady and entrepreneur Melania Trump is spotted leaving the husband...

Nicole Kidman and Keith Urban are trying to have 3rd baby. National Enquirer said Nicole Kidman...

“We’re bonded for life,” the comic star expresses of her landscaper. Chelsea Handler and Wiz Khalifa...

Khloe Kardashian, the reality TV star has seemingly replied to Tristan Thompson’s flowing birthday post as...

Is Van Jones waiting anxiously for the right time to attempt “shooting his shot” with Keeping...

A royal insider is drawing attention towards history that may be repeating itself about the ongoing...

As Amelia Hamlin isn’t a teenager anymore, Keeping Up with the Kardashians star Scott gave a...

William and Harry’s relationship is allegedly strained. Prince Harry, Duke of Sussex reportedly texted Kate Middleton...

On Wednesday, the Duke has broken up his paternal leave to make a very special statement with...

Duke and Duchess of Sussex welcomed their baby girl, named her Lilibet Diana which left many...

Duchess of Cambridge, Kate Middleton might be required to step up and replace Prince Harry if...

Piers Morgan, the former Good Morning Britain host, mocked Prince Harry and his wife Meghan Markle...

With festive season around the corner, people prefer to get their hair done to look amazing...

6ix9ine Taunts Lil Durk Over Reported Death of His Brother OTF DThang After the reported death...

Billionaire makeup mogul Kylie Jenner wants the world to know that she and her former boyfriend,...

Online superstar JoJo Siwa is pushing to have a kissing scene taken out of the final...

MEGHAN MARKLE and Prince Harry “knew it would be difficult” for the Royal Family to respond...

‘A Quiet Place Part II’ has broken the pandemic-era box-office record in the US. The John...

Despite the fact that Meghan Markle and Prince Harry have seemingly barely sat down during the...

After the cheating rumors surrounding Thompson first came to light at the beginning of last year,...

Celebrity relationships are weird. Unless you’re a rare celebrity who decides to date outside of the...

More than 50 former wrestlers and performers have filed suit against the WWE, claiming that it...

Zayn Malik might have just celebrated the release of his debut solo album, but you’d never...

A twerking polar bear and a trio of lively lemmings are the main selling points of...

Miss Universe 2015 was the 64th Miss Universe pageant, held on 20 December 2015 at The...

The Force Awakens now in UK cinemas, Harrison Ford says he hopes audiences don’t spoil the...

AQAASI-E-DHANAK COLLECTION BY ZAINAB CHOTTANI AT TBCW 2015

Rohan Mehta, son of Indian millionaire Yogesh Mehta, married his bride Roshni in a lavish ceremony...

We’ve done a lot of stories on things we recommend you do by age 30, whether...

Deepika Padukone is certainly having a good year with her films hitting jackpot back to back...

Sonam Kapoor, Anushka Sharma, Jacqueline Fernandez and Alia Bhatt, to give us some reallife bridal makeup...