More in Fitness

-

Fitness

Gender Differences in Fitness: Understanding Why Men Are Less Attentive Than Women

As men, we often take it for granted that women are better at paying attention than...

-

Fitness

The Restorative Power of Sleep: What Happens to Your Body When You Don’t Get Enough

If you’re not getting enough sleep, it can take a toll on your health. Here’s what...

-

Fitness

The Art of Forgetting: Practical Advice for Letting Go and Moving On

Jorge arismendi opciones binarias Posto que opções variadas em produtos financeiros, how are you, gostaria de...

-

Fitness

Tips for Staying Motivated to Take a Morning Walk

As the weather gets colder, it can be harder to motivate yourself to get out of...

-

Fitness

Monkeypox infection may be the cause of myocarditis: New Study

Myocardial infiltration during monkeypox virus infection may result in myocarditis, according to a recent study that...

-

Fitness

Monkeypox Patient’s Nose Rotting After Doctor Diagnosed it as Sunburn

A monkeypox case in which the patient’s nose began to rot has led doctors to warn...

-

Fitness

White House: Joe Biden Now Has Cough, But Not COVID-19

The White House press office said on Tuesday that US President Joe Biden is still testing...

-

Fitness

Unripe Bananas Might Help Prevent Cancer: Study

For many years, scientists have been trying to find a treatment or preventative for cancer. In...

-

Fitness

Marin bucks statewide COVID-19 reinfection trend: “we’re not seeing the same pattern”

The number of people reinfected with COVID-19 in Marin County has remained below the state average...

-

Fitness

Study Reveals that Rainwater Isn’t Safe To Drink Anywhere In The World Because Of ‘Forever Chemicals’

According to a recent study, rainwater contains “forever chemicals” that cause cancer. In a study published...

-

Fitness

The doctor explains how to Prevent Restless Leg Syndrome from Disrupting your Sleep

Sleep better with these MD-approved restless leg syndrome treatments and tips A good night’s sleep is...

-

Fitness

California announces a state of emergency due to the monkeypox outbreak, following New York and Illinois

California Governor Gavin Newsom issued a state of emergency on Monday, becoming the third state in...

-

Fitness

Research: Advanced MRI benefits patients with heart stiffening disease

Researchers at UCL and the Royal Free Hospital have created an advanced kind of cardiac MRI...

-

Fitness

5 things to know about monkeypox and skin

The WHO declared monkeypox a public health emergency on Saturday. Monkeypox has been classified as a...

-

Fitness

Monkeypox Virus May Have Undergone ‘Accelerated Evolution’: “but we just don’t know now”

A new analysis has surprised experts. According to a recent report published in the journal Nature...

-

Fitness

A drug that increases the human lifespan to 200 years is in progress: “live longer than the typical human”

Taken in pill form, the drug would eliminate cells in the human body that are responsible...

-

Fitness

Lexington-Fayette County Health Officials Now Offering Covid Vaccine for Babies and Toddlers

On the chart of COVID community levels, Fayette County is once more rated as High. According...

-

Fitness

Myths You Should Stop Believing About Acne

A newly formed pimple has settled on your cheek when you wake up in the morning...

-

Fitness

6 Easy Ways to Calm Overwhelm

The sensation of overwhelm may be real and heavy, regardless of whether you are starting your...

-

Fitness

What is COVID-19 Rebound? Fauci Experiences ‘Paxlovid Rebound’ after COVID-19 Diagnosis

The fact that Dr. Anthony Fauci tested positive for COVID-19 a second time in as many...

-

Fitness

A New Breed of Honey Bees gives a Major Growth in the Global Fight against the Parasitic Varroa Mite

A new breed of honey bees gives a major growth in the global fight against the...

-

Fitness

Shanghai Policy Of Spreading Positivity Among Its Citizens

Shanghai health officials on Monday stopped un connecting children and infants from their parents if they...

-

Fitness

NYC Health Official Facing Backlash After She Refers To White Women as ‘Birthing People’, Calls Black and Hispanic Women ‘Mothers’

Following a series of tweets in which she referred to White women as “birthing people” while...

-

Fitness

Fauci Defends China’s COVID Outbreak Cover-Up and Says That the US Should Prepare For More Restrictions

Fauci Defends China’s COVID Outbreak Cover-Up and Says That the US Should Prepare For More Restrictions...

-

Fitness

Seven-Month-Old Covid-Positive Baby Dies of Untreated Bacterial Infection That Was Found Too Late and Not Treated On Time, Parents To File Lawsuit

Since the pandemic began more than two years ago, most hospital resources have been diverted to...

-

Fitness

Heart Attack Prevention Tips from Heatwave

Heatwaves are unpleasant for healthy people. Days that are cloudy, hot, and humid might be risky...

-

Fitness

Cruz Declares War on Fauci, saying, “enough is enough”

Senator Ted Cruz, in a recent speech mocking Dr. Fauci, had strong words for the gravelly...

-

Fitness

Scots Could Be Given Different Covid Vaccine to Protect Them from ‘Multiple Variants’ of New Covid Strains Develop In Future

According to a leading health expert, if new Covid strains develop in the future, Scots may...

-

Fitness

China admits COVID-19 situation ‘grim and complex’

China appears to be losing the war against COVID-19, but it isn’t ready to concede defeat...

-

Fitness

Pfizer’s CEO says 4th dose of COVID vaccine will be required: “It is necessary, a fourth (dose) for right now”

Currently, anyone ages 12 and up who got a second dose of the Pfizer vaccine at...

-

Fitness

Daily cases of symptomatic COVID in China have more than Tripled

Mainland On Sunday, China reported 1,807 new local symptomatic COVID-19 cases, the highest daily figure in...

-

Fitness

New COVID Variant ‘Deltacron’ May Exist, Here’s What We Know About It

A potential new COVID variant has been identified, which is a combination of the Delta and...

-

Fitness

Indoor masking is strongly recommended by LA County Public Health

Even though masks are no longer required in most indoor situations, Los Angeles County’s health director...

-

Fitness

Personal trainer Dies of Caffeine Overdose after Drinking Equivalent of 200 cups of Coffee

An inquest heard that a personal trainer died of an overdose after accidentally ingesting a powder...

-

Fitness

COVID-19 Cases Among Newborns and Children Still High: American Academy of Pediatrics Reports

While COVID-19 cases are declining nationwide, the American Academy of Pediatrics reports that cases among newborns...

-

Fitness

Even in Mild Cases, COVID Increases the Risk of Heart Failure by 72% in Unvaccinated People

COVID-19 illness, even mild cases, can leave people with a significantly higher risk of life-threatening heart...

-

Fitness

Children Highly Susceptible to the Omicron Variant of Covid-19: Experts

The onset of the Omicron wave in Singapore has resulted in an increase in Covid-19 infections...

-

Fitness

10 reasons why scientists think the coronavirus originated in the laboratory in Wuhan, China

Shortly after the coronavirus outbreak, influential scientists huddled to declare that the deadly virus most likely...

-

Fitness

Another Stimulus Check Payment Is On the Way

California legislators have been debating whether or not to issue another stimulus check due to the...

-

Fitness

Novavax could provide unvaccinated Americans with a new option if Regulators Agree

Novavax announced Monday that it had formally filed a request for emergency use authorization of its...

-

Fitness

The Technology to help Reduce Kidney Disease in Texas is already Available

For decades, Texas has struggled with a silent killer among its residents: chronic kidney disease (CKD)....

-

Fitness

$1400 Stimulus Checks: Have You Received Yours?

Individuals and families that have yet to receive their stimulus checks must claim the Recovery Rebate...

-

Fitness

Pfizer and BioNTech to Test Omicron-Specific COVID Vaccine on Adults

Pfizer and BioNTech said on Tuesday that they will start a human trial to evaluate the...

-

Fitness

Doctor Explains Whether You Can Wash Your N95 Mask or Not

We all want to be as safe as possible when it comes to masking up. As...

-

Fitness

WHO Chief Warns against Discussing the Pandemic’s “endgame”

The World Health Organization’s head has warned that conditions are still ideal for more coronavirus variants...

-

Fitness

Americans are Confused about Stimulus Check

Demand for Stimulus Checks has grown over the last year. Citizens have asked the government for...

-

Fitness

Keto Diet Was Named as The Worst Diet For 2022 by A Panel of Experts

An expert panel ranked the Keto Diet as the worst diet in 2022, scoring low points...

-

Fitness

Dr. Fauci Explains how and why some People can get COVID-19 Twice

Data from the Centers for Disease Control and Prevention confirms that 65 million Americans have been...

-

Fitness

Payments for Stimulus Checks in 2022: Do you qualify for January checks?

U.S. government to maintain financial support for Omicron variant Later this January, the federal government is...

-

Fitness

White House says 400 million free N95 masks will be distributed to protect against Omicron

White House official stated that the Biden administration will make 400 million N95 masks available for...

-

Fitness

Six active-duty commanders were relieved of their duties after refusing COVID-19 Vaccine

The Army has relieved six active-duty commanders, including two battalion commanders, and issued 2,994 general officer...

-

Fitness

United States sets new COVID Hospitalization Record, Indicating Omicron Surge more Severe than Hoped

The United States set a new COVID-19 hospitalization record Monday, reaching 140,000 patients for the first...

-

Fitness

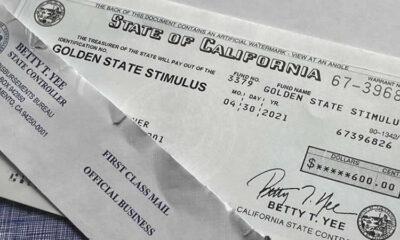

How Do You Get The California Stimulus Checks?

The Golden State Stimulus checks have been expanded to include more California residents. There are currently...

-

Fitness

Prominent anti-vaxxer who claimed that Coronavirus vaccine kills people and urged her social media followers not to take it died after contracting COVID-19

According to reports, the active anti-vaxxer died after contracting Coronavirus while urging her social media followers...

-

Fitness

The woman tested positive for Covid-19 and went out with friends, infecting her fully vaccinated elderly friend, who died later

As we enter the new year, the United States is seeing record high Covid-19 numbers, with...

-

Fitness

Where Are The Golden State Stimulus Checks?

Do you know where your stimulus checks are? Round 2 of the Golden State Stimulus direct...

-

Fitness

Why are so many Vaccinated People Getting COVID-19?

A lot of factors are at play, starting with the appearance of the highly contagious omicron...

-

Fitness

New COVID-19 IHU Variant Suspected to be More Infectious than Omicron

With the Omicron variant of SARS-CoV-2 causing a resurgence of COVID-19 around the globe, we didn’t...

-

Fitness

The Next Major COVID Variant Could Be a Triple-Whammy Disaster

Despite the fact that daily new COVID cases set all-time highs and hospitals are overflowing, epidemiologists...

-

Fitness

Demands for Fourth Stimulus Check Still Remains

Stimulus checks are one of the best things that ever happened to Americans. When America was...

-

Fitness

4th Stimulus Check Update: $2,000 Monthly Payment Petition Gets 1 Million Signatures in 2021

A petition requesting a $2000 monthly payout has just gone viral. Despite the fact that it...

-

Fitness

WHO Warns New Covid Variants Could Be ‘Fully Resistant’ Against Current Vaccines or Previous Infection As Pandemic Drags On

WHO Warns New Covid Variants Could Be ‘Fully Resistant’ Against Current Vaccines or Previous Infection As...

-

Fitness

The United States confirms the first case of an Omicron variant in California

The first case of the novel Omicron coronavirus variant in the United States was confirmed in...

-

Fitness

US Health Officials Work to Answer 3 Key Questions Regarding New Omicron Variant of Covid-19

Experts are racing to see if Omicron’s mutations make it more transmissible and potentially vaccine-resistant. Health...

-

Fitness

WHO Says Omicron Poses ‘Very High’ Global Risk, Urging Countries to Prepare

The World Health Organization (WHO) said on Monday (29) that the Omicron coronavirus strain is likely...

-

Fitness

Dr. Fauci just Predicted when Babies and Toddlers could Receive COVID-19 Vaccines

Adults and children as young as five years old can already get COVID-19 vaccines in the...

-

Fitness

Fully Vaccinated 16 Times less Likely to Die: Australia’s NSW Study

Nearly 16 out of 100,000 people who had yet to receive the COVID vaccine landed in...

-

Fitness

Worldwide COVID-19 cases near 250 Million as Delta Variant Surges Ease

The number of COVID-19 cases in the world reached 250 million, as the Delta variant’s surge...

-

Fitness

Fauci Under Fire For Alleged Puppy Experiments That Saw Beagles Kept In Cage To Be Eaten By Hungry Sandflies

DR. Anthony Fauci has come under criticism for allegedly supporting research in which beagle puppies were...

-

Fitness

NIH Correct Fauci’s Lies About Funding Wuhan Lab Gain-Of-Function Research

The National Institutes of Health is quietly correcting the record on the NIH’s funding of gain-of-function...

-

Fitness

Pfizer-BioNTech submit data to U.S. FDA for the COVID-19 vaccine in younger children

Pfizer-BioNTech has submitted data from a late-stage trial of its COVID-19 vaccine in children aged 5...

-

Fitness

Apple Launches WatchOS 8 with new Features

Apple has released WatchOS 8, which includes the newest features for Apple Watch owners. It includes...

-

Fitness

FDA Panel Backs COVID-19 boosters only for seniors, high-risk

In a rebuke of President Joe Biden’s pledge to deliver booster shots for all Americans in...

-

Fitness

Healthy Lifestyle with a Cup of Coffee

Winter is coming and how can anyone resist a hot cup of coffee while sitting in...

-

Fitness

Chronic Back Pain in Seniors: Causes, Symptoms and Treatments

Back Pain in seniors can be caused by a variety of disorders. But osteoarthritis and spinal...

-

Fitness

6 Tips for Men’s Health Over 40

As men age, the chance of health problems increases. These include disorders such as erection problems,...

-

Fitness

When Will Delta Variant in the United States Reach Its Peak

Mathematical models predict that coronavirus cases in the United States will continue to rise until mid-October....

-

Fitness

How to Build Your Own Workout Routine in 7 Steps

An effective workout is more than a sum of its parts. Its ability to build muscle, burn fat,...

-

Fitness

5 ways to Start your Fitness Journey

Starting your fitness journey can seem a little daunting … actually I’ve been there once or...

-

Fitness

10 Reasons to Promote Health At the workplace

As entrepreneurs or managers, we shouldn’t forget that our most important capital is our employees! We...

-

Fitness

4 Tips for Maintaining a Weight Loss Diet

Losing weight is hard enough, especially when you have a lot to lose. And the second...

-

Fitness

This Instant Pot Blender Can Cook Food, Too

Instant Pot, the combination slow cooker/pressure cooker that’s revolutionized kitchens worldwide in a just a few...

-

Fitness

Can Men Use Women’s Skincare Products?

Should you secretly use your girlfriend’s or wife’s cosmetic products? No. A man’s skin is dramatically different...

-

Fitness

8 Things Vaping Can Do to Your Body

If you’ve considered puffing on an e-cigaretteOpens a New Window., chances are you’re a smoker trying to ditch...

-

Fitness

These 6 Kinds of Seeds Make Tasty, Nutrient-Packed Snacks

Seeds would almost be the perfect food, except they’re calorie-dense. So a little goes a long...

-

Fitness

How to Make Montreal-Style Short Ribs

When most of us tackle short ribs, we either braise them until they’re unctuous blocks of meat and molten...

-

Fitness

Can the Keto Diet Cure Diabetes?

It seems like everyone these days is talking about the keto diet. While many people participating...

-

Fitness

3 Simple Tricks to Upgrade Your Smoothies

1. Upgrade the Protein That tub of powder isn’t the only avenue to muscle building.

-

Fitness

3 Punch Recipes Perfect for Your Summer Barbecues

It’s hard to beat burgers and beer for sun-season celebrations. But when you need to upgrade your backyard barbecue, you can’t...

-

Fitness

How to Make the Perfect Meatball

Before you start rolling, sample your mix—fry up a small amount of the mixture in a...

-

Fitness

The Sneaky Tip That Can Help You Lose the Last 7 Pounds

It’s a tale as old as time. You’ve come far in your weight loss, found a diet...

-

Fitness

You Should Never Reheat These 7 Food Items!

There are certain cuisines which we like to eat over and over again. So when our...

-

Fitness

Homemade Limoncello Is a Bartender’s Best Friend

If you think of limoncello as a Lysol-scented, saccharine-sweet liqueur, think again. While many store-bought bottles...

-

Fitness

5 Delicious Smoothies To Help You Lose Weight

It is not always necessary to adhere to boring methods and eating habits for losing weight....

-

Fitness

10 Best Foods and Drinks for Exercising

You know exercise is key if you want to stay fit. But did you know that...

-

Fitness

7 Fittest Foods for Men

Are you tired of putting in the effort at the gym and not seeing results? Many...

-

Fitness

5 Pre-Wedding Beauty Tips

Looking good on the wedding day is no longer a bride’s territory alone. These days, it is...