More in Politics

-

Politics

Trump’s Attorneys Face Challenges: High Costs and His Unpredictable Actions Present Major Representation Hurdles

According to a recent report, the extensive legal team that former President Donald Trump has gathered...

-

Politics

Empowering the Fight Against Covert Drugging: Montana Law Amplifies Legal Stance on ‘Date-Rape Drugs

In a substantial legislative move, Montana enforces a new law designed to strengthen policies surrounding the...

-

Politics

Start of Trump’s $250 Million Civil Fraud Lawsuit: A Pivotal Moment in New York Court

The New York attorney general’s office has initiated a substantial $250 million civil fraud lawsuit against...

-

Politics

Trump Claims He Left a ‘Nice Note’ for Biden When He Left the White House in 2021

According to reports from The New York Post on Saturday, September 16, 2023, former President Donald...

-

Politics

Ivanka Trump Surprises Maui: An Unexpected Journey to Deliver Meals to Families

The Hawaiian island of Maui saw an unexpected yet wholeheartedly welcomed guest a few weeks back...

-

Politics

U.S. Calls for Public Assistance in Tracking Down Vanished F-35 Jet After Pilot Ejects

The U.S. military’s state-of-the-art F-35 jet has seemingly evaded its own team after a mishap led...

-

Politics

White House’s 9/11 Analogy for Biden’s Absence Raises Eyebrows

While President Biden marked the 22nd anniversary of the 9/11 attacks in Alaska, questions arose regarding...

-

Politics

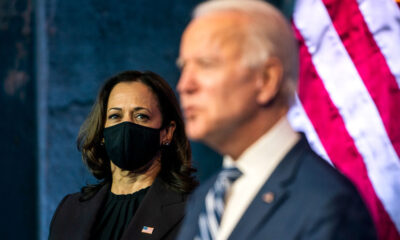

Kamala Harris’s Bold Statement: ‘Ready to Assume Presidency’ if Biden Can’t Complete Term

U.S. Vice President Kamala Harris, on a diplomatic mission to Jakarta, responded to questions regarding President...

-

Politics

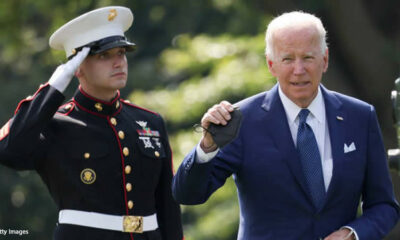

Controversy Shadows Medal of Honor Ceremony as Biden Exits Early

Tuesday’s Medal of Honor ceremony at the White House took an unexpected turn when President Biden...

-

Politics

Flames Erupt During Unauthorized Stunt Driving, Caught on Camera

A driver in Miami brought traffic to a standstill on an already congested holiday weekend by...

-

Politics

Trump Amplifies Anti-Trans Sentiment with Lady Weightlifter Impression

Donald Trump, aiming to resonate with conservative voters, once again showcased his anti-trans stance by performing...

-

Politics

Divergent Father’s Day Messages from Donald Trump and Joe Biden

President Joe Biden and potential 2024 Republican candidate Donald Trump both shared Father’s Day messages on...

-

Politics

Comer Admits Nobody Has Heard From Alleged Biden Informant for Three Years

James Comer, the Kentucky Representative chairing the House Oversight Committee, has conceded that the committee lost...

-

Politics

Trump’s Low Blow: Retaliating Against Chris Christie for Criticizing Ivanka Trump & Jared Kushner

Following Chris Christie’s announcement to challenge Donald Trump for the Republican Party nomination in 2024, the...

-

Politics

Trump’s legal team and Manhattan prosecutors are at odds about where he will stand trial

Ten months before Donald Trump’s historic New York City criminal trial, Manhattan prosecutors are using the...

-

Politics

Trump claims his supporters did not just gift him $5 million in 48 hours, more than 16,000 people joined as campaign volunteers within two days of his indictment

In the 48 hours following Trump’s indictment, his presidential campaign said it got $5 million in...

-

Politics

Trump raises his arrogance as legal barriers close in: ‘Like lighting a match’

Donald Trump is aware of the camera. He is particular about angles, lighting, and his signature...

-

Politics

The White House dodges the issue of whether the ‘assault weapons ban will result in ‘confiscation’

Karine Jean-Pierre, the White House press assistant, dodged a query Wednesday about whether President Biden’s planned...

-

Politics

Biden claims several Second Amendment claims in the aftermath of the Nashville shooting, but the reality is more complex

President Biden addressed Monday’s deadly school killings in Nashville, Tennessee during a visit to North Carolina...

-

Politics

Kimberly Guilfoyle Looks Beautiful in a Blue Dress After Defending Donald Trump

Kimberly Guilfoyle flaunted her figure in her most recent Instagram Story. On March 26, the conservative...

-

Politics

Trump threatens ‘possible death and devastation’ if he’s charged in hush money investigation

Former President Donald Trump increased his criticism against the Manhattan district attorney’s investigation into a hush...

-

Politics

Trump’s legal drama may push America closer to a historic turning point

Donald Trump’s legal situation seemed to worsen on Wednesday. The country moves closer to a political...

-

Politics

A judge orders Trump’s lawyer to testify in an investigation into classified documents: REPORTS

A federal judge quietly decided on Friday that Donald Trump‘s counsel must testify before a federal...

-

Politics

Federal authorities investigated Trump Media for alleged money laundering: Source

According to sources familiar with the matter, federal prosecutors in New York involved in the criminal...

-

Politics

Trump blames Mike Pence for January 6 riots on refusal to back a coup attempt

Donald Trump, whose coup attempt on Jan. 6, 2021, put his vice president’s life at risk...

-

Politics

Trump Adds Fuel to the Fire After Silicon Valley Bank’s Collapse

Former President Donald Trump fueled speculations of doom and gloom as he dove into the news...

-

Politics

After Bidens caused a stir by ordering the same dish twice while dining out, an etiquette expert weighs in

President Joe Biden and first lady Jill Biden both ordered the same rigatoni dish, sparking a...

-

Politics

Donald Trump’s Surprising Reaction to Losing Major Support: “I told Nikki to follow her heart”

South Carolina Republican Rep. Ralph Norman described Donald Trump as “benevolent” when he called to announce...

-

Politics

BBC announces the release of a new documentary and podcast on Kanye West

Kanye West’s “rollercoaster life and career” will be the focus of a new BBC documentary, which...

-

Politics

Trump Grand Jury Says Witnesses May Have Lied Under Oath: “All I want to do is this”

The special grand jury investigating former President Donald Trump’s efforts for re-election in Georgia in 2020...

-

Politics

Trump White House urged Twitter to remove Chrissy Teigen’s derogatory tweet against him

A former Twitter employee has given new insight into the company’s relations with the White House...

-

Politics

Trump seeking almost $1 million in fines for his ‘frivolous’ lawsuit against Hillary Clinton

Former President Donald Trump and one of his lawyers said Monday that they will appeal almost...

-

Politics

Biden administration intends to end COVID public health emergency in May

President Joe Biden of the United States has told Congress that on May 11, his administration...

-

Politics

Biden announced the United States would send 31 Abrams tanks to Ukraine

President Joe Biden stated on Wednesday that the US will send 31 Abrams tanks to Ukraine...

-

Politics

Trump hires a strong legal team to pursue former Manhattan prosecutor

Donald Trump has hired one of America’s best trial lawyers to go after a former Manhattan...

-

Politics

Former Trump Official to High School Students: “You have to do your part”

Roger Severino, the former director of the Office of Civil Rights at the Department of Health...

-

Politics

DC appeals court will decide whether E. Jean Carroll may sue Donald Trump for rape, being president makes him immune: Justice Department

The District of Columbia Court of Appeals heard arguments in former President Donald Trump’s appeal of...

-

Politics

Trump’s special counsel Jack Smith was given an “easy case” that could be “prosecuted at any time”

Former federal prosecutor Cynthia Alksne remarked on MSNBC’s “The Katie Phang Show” early Saturday morning that...

-

Politics

Kevin Mccarthy Must Commit To A Government Suspension Over Raising Of Debt Ceiling: Freedom Caucus Holdout

REP. KEVIN MCCARTHY would have to commit to “shutting down the government rather than raising the...

-

Politics

Suspect arrested in connection with New Year’s Eve machete assault on police officers near Times Square

The 19-year-old man suspected of using a machete to attack three police officers in Times Square...

-

Politics

‘Incredibly Damning Statements’: Former Prosecutor For Robert Mueller Sees Trouble For Trump

Former President Donald Trump rang in the new year at Mar-a-Lago with a New Year’s Eve...

-

Politics

Hughley asks for Donald Trump to be charged with manslaughter

Donald Trump, the former US president and current presidential candidate for 2024, did not conclude 2022...

-

Politics

Far-Right Republican Unloads on Marjorie Taylor Greene: You ‘Crossed a Rubicon!’

GOP infighting over who will become the next speaker appears to be boiling over. Far-right Rep....

-

Politics

Trump accuses “seriously troubled man” Kanye West of Invited White Supremacist to Dinner at Mar-a-Lago

Over the weekend, former President Donald Trump claimed that Ye, then known as Kanye West, invited...

-

Politics

Tucker Carlson presents Biden’s biggest blunders: ‘What did he just say?’

‘Tucker Carlson Originals: The Joe Biden Christmas Special’ is streaming now, exclusively on Fox Nation. This...

-

Politics

Bill Clinton Compared Donald Trump To Tony Goldwyn, Martin Sheen, And Michael Douglas

When asked a question on a late-night talk show, a former president took a dig at...

-

Politics

Barack Obama Reveals Favorite Movies, Music, and Books of 2022: “I always look forward to sharing my lists with all of you”

‘The Fabelmans,’ ‘The Woman King,’ ‘Tár,’ ‘Everything Everywhere All at Once,’ Lizzo, Bad Bunny, SZA, and...

-

Politics

Meghan McCain Responds to Being Called “Deranged” Over the “New York Times” Swastika Debate

Meghan McCain has reacted angrily to Eric Swalwell’s description of her as “deranged” in reaction to...

-

Politics

DeSantis’ recent education plan specifically targets teachers’ unions by eliminating automatic dues in favor of monthly mailed-in checks

Florida Republican Gov. Ron DeSantis announced Monday that he will sign bills increasing teacher salaries by...

-

Politics

Trump’s lawsuit over Mar-a-Lago search officially dismissed by a federal judge

A federal court in Florida dismissed former President Donald Trump’s complaint against the FBI for searching...

-

Politics

Republican representative sobbed as she begged her colleagues to vote against the bill allowing same-s*ex marriage

Rep. Vicky Hartzler of Missouri cried on the House floor on Thursday as she asked her...

-

Politics

Elon Musk’s feud with Donald Trump has continued after he criticized the ex-president’s call for the US constitution to be “terminated”

The billionaire just recently let the controversial mogul-turned-politician back on Twitter after his takeover after putting...

-

Politics

Trump asks for the Constitution to be abolished via Truth Social post

In a continuation of his election denial and promotion of fringe conspiracy theories, former President Donald...

-

Politics

Kimmel Makes Fun of Trump’s ‘Meeting of the Mindless’ with Kanye West & White Supremacist Nick Fuentes

Of course, you’ve heard about Donald Trump‘s recent dinner with Kanye West and West’s friend, white...

-

Politics

Republicans criticize Trump for meeting with ‘avowed racist’ Nick Fuentes, whom he blames on Kanye West

Republicans criticized former President Donald Trump for hosting controversial musician Ye (Kanye West) and white nationalist...

-

Politics

DeSantis Is Already Polling So Well for President That ‘He’s Only 5 Points Away From Trump Calling It Rigged’: Fallon

According to new polling, Florida Governor Ron DeSantis seems to be a credible challenger against twice...

-

Politics

Karine Jean-Pierre was criticized for shouting down reporters: “We have a process here. I’m not calling out on people who yell”

White House press secretary Karine Jean-Pierre faced further criticism from reporters and Twitter users alike after...

-

Politics

Trump Would Be ‘Well-Advised’ to Lawyer Up Before E. Jean Carroll Files Her Rape Lawsuit: Federal Judge

Attorneys representing writer E. Jean Carroll battled with the former president’s lawyer in federal court two...

-

Politics

USDA blames Russia for the increased price of Thanksgiving dinner

Russia’s ongoing war in Ukraine is one of the reasons your Thanksgiving feast will cost more...

-

Politics

Michael Cohen thinks Ivanka Trump’s self-exile from politics is due to her role as the FBI’s mole at Mar-a-Lago

Former President Donald Trump’s daughter Ivanka is withdrawing from politics because she and her husband, Jared...

-

Politics

Donald Trump responds as Elon Musk restores his Twitter account: “Truth Social is special!”

Donald Trump has been formally reinstated on Twitter, but the former president voiced concerns about his...

-

Politics

Trump announces his 3rd presidential candidacy: “We will be attacked”

Former President Donald Trump formally launched his candidacy for president in 2024, his third try. Trump...

-

Politics

Republicans question Biden’s homeland security chief in a possible preview of upcoming Congress: “Worldwide Threats to the Homeland”

Republicans chastised U.S. Homeland Security Secretary Alejandro Mayorkas at a congressional hearing on Tuesday and called...

-

Politics

Kari Lake blasts her Democratic opponent for not recusing herself as election chief despite her candidacy

Republican Arizona gubernatorial candidate Kari Lake blasted her Democratic opponent for failing to recuse herself as...

-

Politics

US awaits a decision on Biden in key polls As Trump prepares for a comeback bid: REPORTS

A polarized America braced for a tense night of election results and legal challenges on Tuesday,...

-

Politics

Ted Cruz hit with beer can during Astros World Series parade in Houston: man arrested

The senator from Texas was not hurt. The aggravated assault has been charged against a defendant....

-

Politics

Ken Griffin says it’s time to ‘move on from Trump, backs DeSantis for 2024

Republican mega-donor Ken Griffin believes it is time for the Republican Party to look beyond former...

-

Politics

Manchin demands Biden apologize for his ‘outrageous’ coal remarks

Senator Joe Manchin demanded Saturday that President Biden apologizes for saying coal plants “all across America”...

-

Politics

Hillary Clinton and other top Democrats filed a motion to sanction Trump for a ‘frivolous’ lawsuit

According to USA Today, former Secretary of State Hillary Clinton joined a number of other top...

-

Politics

Clinton demands Trump pay legal fees for blackmail lawsuit

Hillary Clinton wants former President Donald Trump to pay her legal fees after a judge dismissed...

-

Politics

Trump Should Be ‘Prosecuted’ After Pelosi Attack

Following the attack on Paul Pelosi, husband of House Speaker Nancy Pelosi, former federal prosecutor Glenn...

-

Politics

US Midterm elections 2022: Biden’s bad 2024 numbers improve, while Trump’s bad numbers get worse

A new USA TODAY/Suffolk University Poll finds that Americans are still not interested in a rematch...

-

Politics

Trump’s lawyers accept a court order from a House committee on January 6

The subpoena calls for the former president to testify either at the Capitol or by videoconference...

-

Politics

White House calls for weapon ban after St. Louis school shooting

“Every day that the Senate fails to send an assault weapons ban to the president’s desk...

-

Politics

Ted Cruz took shelter in a supply closet during January 6 riot: Book

Texas senator wrote he ‘vehemently disagreed’ with colleagues’ call to allow certification of 2020 election Ted...

-

Politics

WATCH: Trump Rally Crowd Suddenly Starts Singing National Anthem As He’s in Middle of Sentence About January 6

On Saturday, ex-President Donald Trump was speaking about the January 6 committee and Rep. Liz Cheney...

-

Politics

Legal Experts Evaluate Trump’s Latest Challenging Day in Court

A New York judge denied former President Donald Trump’s request to relocate the fraud lawsuit against...

-

Politics

Trump deposed in a defamation case filed by E. Jean Carroll: REPORTS

Former President Donald Trump testified under oath Wednesday in a lawsuit filed by E. Jean Carroll,...

-

Politics

Trump employee saw moving boxes on Mar-a-Lago security footage identified as former White House worker: REPORTS

A source confirms to CBS News that an employee at former President Donald Trump’s Mar-a-Lago resort...

-

Politics

WATCH: Marjorie Taylor Greene says she’s a victim of the Jan. 6 riot during the debate

Rep. Marjorie Taylor Greene (R-GA) accused her opponent for her seat in congress, Marcus Flowers, of...

-

Politics

Trump’s Truth Social violated the law, claims former vice president — who provided Feds with evidence: report

Federal investigators have received evidence of crimes from a former executive at the Trump Media &...

-

Politics

Trump threatened to reveal confidential sources in Russia investigation: Reports

Donald Trump considered revealing the identities of confidential official sources from his first impeachment, according to...

-

Politics

Legal Experts Applaud Justice Department’s ‘Compelling’ Response to Trump’s SCOTUS Appeal

A Department of Justice (DOJ) filing in response to former President Donald Trump’s request for the...

-

Politics

Mueller’s prosecutor claims Trump provided DOJ “damning evidence” at MAGA rally

Former President Donald Trump made it easier for the Justice Department to bring a criminal case...

-

Politics

Devastation after Russian bombs across Ukraine, as at least 11 dead in Kyiv: Video

The morning’s brutal attack on the Ukrainian capital of Kyiv was captured on camera from across...

-

Politics

Trump’s attempt to blame General Services Administration for Mar-a-Lago documents destroyed by new documents

An attempt by former president Donald Trump to blame the General Services Administration for having top-secret...

-

Politics

Trump caught in a lie after a new audio clip surfaced

In an interview with New York Times reporter Maggie Haberman last year for her upcoming book,...

-

Politics

Maggie Haberman claims lack of reporting ensures Trump escaped accountability

The 600-page book by New York Times reporter Maggie Haberman will be released on Tuesday at...

-

Politics

Trump disregards Hurricane Ian risks and refuses to reschedule a video-phone fraud deposition in Florida

Donald Trump refused to postpone a deposition in a class-action fraud lawsuit involving video phones, despite...

-

Politics

Marjorie Taylor Greene’s husband files for divorce: REPORTS

Perry Greene, the husband of far-right Rep. Marjorie Taylor Greene (R-GA), filed for divorce on Wednesday,...

-

Politics

Donald Trump Had Racist Reaction To Staff Members Of Color At White House: Book Claims

His chief of staff had to correct him. Donald Trump allegedly made a racist assumption about...

-

Politics

NY Music Festival: Nancy Pelosi booed during a surprise appearance

Mariah Carey, Metallica, The Jonas Brothers, and Usher performed at the festival On Saturday night, attendees...

-

Politics

Pro-Trump ‘Truth’ Rally Fizzles: Draws Almost As Many Opponents

According to multiple reports, only a few dozen people attended a right-wing January 6 “Truth” rally...

-

Politics

Trump’s aides were shocked by his ignorance and that he “knew nothing about so many things”

If his single term in office didn’t make it clear, Donald Trump wasn’t exactly prepared to...

-

Politics

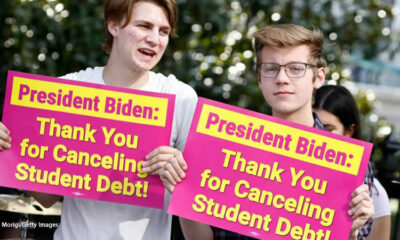

How to Get a Refund for Student Loan If You Paid During Pandemic: Details

When President Joe Biden announced a plan to forgive student loan debt, many borrowers who had...

-

Politics

New footage shows fake Trump elector spent hours inside Georgia elections office the day it was violated: Reports

Newly obtained surveillance video showing a group of Trump supporters inside a restricted area of a...

-

Politics

Trump world bears down: ‘Every day feels like something else is piling on

The former president’s advisers fear that the DOJ probes are more expansive than publicly known. When...

-

Politics

Moscow Officials Urge Putin to GTFO: ‘Everything went wrong

As Moscow suffered yet another string of embarrassing losses in Ukraine this weekend, more and more...

-

Politics

Barack Obama and Wife Michelle Return to the White House

In attendance at the unveiling of their official portraits alongside President Joe Biden and First Lady...

-

Politics

Media Critics Not Buying Biden White House’s ‘Startling’ Efforts to Blame Trump for COVID School Woes

Trump’s push to reopen schools in 2020 was criticized by mainstream media outlets as being reckless....

-

Politics

Hillary Clinton claims that ‘suggestive’ upskirt photos inspired her to start wearing pantsuits

After “suggestive” photos of Hillary Clinton in a skirt were taken during her time as the...

-

Politics

Trump received hundreds of millions of dollars from his father’s real estate empire: ‘He lived off his parents’ money’

During a rally in Pennsylvania on Saturday, former President Donald Trump called Democrat candidate Lt. Gov....

-

Politics

Biden’s wandering speech takes a CREEPY turn when he notices a 9-year-old in the audience

On Tuesday, President Joe Biden set off more than a few perv-o-meter alarms when he abruptly...

-

Politics

Report: White House refuses to explain who will pay for Biden’s $500B student loan handout

Economists say taxpayers are likely on the hook for it. President Biden and White House officials...

-

Politics

Former White House adviser claims Biden administration is the “epicenter” of child trafficking

It is self-evident that open borders are harmful to the American people. Many illegal immigrants are...

-

Politics

Newly Released Trump Memo: ‘It Is Clear Why Barr Did Not Want the Public to See’

The head of CREW—which fought for the document’s release—said that “it twists the facts and the...

-

Politics

‘Benedict Donald’ Trump ‘Understood the Stakes in the Search Warrant That Was Executed’: MSNBC Panel

Donald Trump biographer Tim O’Brien explained that even though the former president “isn’t a sophisticated man”...

-

Politics

Trump Frantically Packed Up Documents to Take With Him After Finally Accepting He Was Leaving White House, Report Says

Between the January 6 Capitol attack, challenges to the 2020 election, and his impending second impeachment,...

-

Politics

FBI director makes First Public Comments after Raid on Trump’s Home

Christopher Wray, the director of the FBI, did not respond to investigations on Wednesday regarding an...

-

Politics

Trump Fields calls from Republican Allies to Speed up 2024 bid following FBI Raid

Top Republicans who have spent months trying to stop Donald Trump from starting another presidential campaign...

-

Politics

Lara Trump incorrectly says that Donald Trump had ‘every authority’ to take documents from the White House

Lara, the daughter-in-law of former president Donald Trump, spoke on Tucker Carlson. She discussed the FBI...

-

Politics

Trump says FBI agents raided his Mar-a-Lago Florida home: “not necessary or appropriate”

Classified material from Trump’s presidency was found at his Florida residence in February, a possible breach...

-

Politics

Photos in New Book Reveals First Look inside White House’s Private Rooms Redesigned by Melania Trump

The White House: An Historic Guide, a new book, is offering readers a view inside the...

-

Politics

Trump’s Impeachment Defense Lawyer has a Plan to Stop Him

Tuesday evening, as news broke that the deletion of the text message scandal had moved from...

-

Politics

Biden Tested Positive for COVID in ‘rebound’ case: “I’m still at work”

President Biden tested positive for COVID-19 in a “rebound” case on Saturday, according to the White...

-

Politics

Twitter Bursts over Kamala Harris’ use of pronouns “she/her” her self-introduction, Description of her Clothing

Tuesday’s dinner with Vice President Kamala Harris had her and others introducing themselves at the table...

-

Politics

Former Mike Pence Aides talk to federal grand jury as federal criminal probe of Trump picks up steam

Marc Short and Greg Jacob can provide firsthand accounts of Trump’s attempt to overturn the election...

-

Politics

Bill Clinton hails David Trimble as a leader of courage and vision

Former US President Bill Clinton has paid tribute to former Northern Ireland first minister Lord Trimble,...

-

Politics

Biden says Trump “lacked the courage to act” on January 6 riot: “You can’t be pro-insurrection and pro-cop”

President Biden claimed on Monday that on January 6, 2021, when Trump’s supporters overran the U.S....

-

Politics

Trump Says He Intended to Give Himself Congressional Medal of Honor but was told it was ‘Inappropriate’: ‘They Wouldn’t Let Me Do It’

After he flew to Iraq, the former president believed he was deserving of the honor awarded...

-

Politics

Donald Trump says if he decided not to run for political office the ‘persecution’ towards him would ‘immediately stop’

Former President Donald Trump claimed that Washington would leave him alone if he did not pursue...

-

Politics

White House: Biden Probably Carrying Highly Contagious COVID Subvariant BA.5

The BA.5 subvariant makes up to 80% of COVID-19 infections across much of the US. The...

-

Politics

Jill Biden Heckled by Unknown Bystanders at Connecticut Ice Cream Shop: ‘Your Husband is the Worst’

During a national summer learning tour, First Lady Jill Biden visited Connecticut, where hecklers shouted criticism...

-

Politics

Trump Had ‘Extreme Difficulty’ with His Speech the Day Following Jan. 6 Capitol Riot

According to sources familiar with the committee’s plans, the House committee looking into the uprising intends...

-

Politics

White House in Damage Control Mode as Joe Biden Says He ‘Has Cancer’: “had several localized, non-melanoma skin cancers removed with Mohs surgery”

Joe Biden regularly makes inaccurate remarks during his speeches which his critics believe proves his “mental...

-

Politics

‘The View’ Host Sunny Hostin Criticizes Biden for “Normalizing a Murderer” and fist-bumping the Saudi Crown Prince

Joe Biden’s choice to fist bump Saudi Crown Prince Mohammed bin Salman during a meeting on...

-

Politics

China threatens the United States with “forceful measures” if Nancy Pelosi visits Taiwan

(CNN) – China warned on Tuesday that, in the event that US House of Representatives Speaker...

-

Politics

Two persons were charged with a scheme to offer foreigners access to US leaders, including Trump

Two people have been accused of running a multi-year scheme that allegedly raised at least $27...

-

Politics

Donald Trump Arrives in New York City with Melania Ahead of Ivana’s Funeral Service

Two days prior to his first wife Ivana Trump’s funeral services, former President Donald Trump and...

-

Politics

Kinzinger says Jan. 6 hearing on Trump’s actions will “open people’s eyes in a big way”

Washington —Rep. Adam Kinzinger, a member of the House select committee looking into the assault on...

-

Politics

Kamala Harris loses 2 top assistants as VP’s office continues high turnover rate: “She has brought vision”

Domestic policy adviser Rohini Kosoglu and director of speechwriting Meghan Groob are leaving Vice President Kamala...

-

Politics

Mary Trump Says Donald Trump’s Mental Health is ‘Deteriorating’ Even More under Constant Attacks

Like the rest of us, Mary Trump finds it hard to comprehend that so many people...

-

Politics

AOC confronted a far-right troll on the Capitol steps who made vulgar remarks about her body: “I was actually walking over to deck”

Rep. Alexandria Ocasio-Cortez of New York criticized a far-right troll on Wednesday night who had earlier...

-

Politics

Trump criticizes Elon Musk, and says he could have made him ‘drop to his knees and beg’

Elon Musk has responded to former President Donald Trump’s allegation that he is too old to...

-

Politics

Obama Sent Fiery Email to Ex-White House Doctor After He Questioned Biden’s Cognitive Health

Obama told Jackson, who was the doctor for three presidents, that criticizing Biden’s mental state was...

-

Politics

Republicans are trying to ‘repeal the 20th century,’: Reagan’s lawyer

During a Wednesday appearance on MSNBC, Reagan White House Solicitor General Charles Fried explained how Republicans...

-

Politics

Meghan King Dating Businessman Trevor Colhoun after Separating From Cuffe Biden Owens

After her third unsuccessful marriage, Meghan King is now dating once more. Unnamed sources tell Page...

-

Politics

Trump’s 2024 campaign could change Midterm elections completely: Donald Trump doesn’t care about anybody else

Rumors are swirling that the ex-president could make an announcement soon, as January 6 revelations continue...

-

Politics

2 Officers Shot, Hundreds Flee During July 4th Fireworks in Philly: ‘Run, run, run’

“I didn’t hear the shots, but the cops were like, ‘Run, run, run,’” one woman told...

-

Politics

Trump warned ‘there’s more than one Cassidy Hutchinson’: Reports claim

Former White House aide Cassidy Hutchinson delivered devastating testimony about Trump’s actions and behavior on Jan....

-

Politics

Donald J. Trump, the meanest of the mean girls: “You don’t understand, Mike”

The testimony given on January 6 before the House committee has often been unreliable, mostly because...

-

Politics

The term ‘No-Look Handshake’ Trends on Twitter after Biden was Seen Shaking Hands with South Korea’s President without Making Eye Contact

At the NATO summit in Madrid on Wednesday, US President Joe Biden and his South Korean...

-

Politics

Kellyanne Conway says January 6 Committee Making Big Mistake not Cross-examining Witnesses

It’s pretty ‘remarkable’ Secret Service agents are willing to go under oath, says Conway Kellyanne Conway,...

-

Politics

Arizona’s Republican AG Tells Hecklers To ‘Shut The Hell Up

Trump has attacked Arizona attorney general Mark Brnovich for not doing more to support his efforts...

-

Politics

Country’s Richest People try to Influence the Illinois Race for Governor

In terms of political office, Illinois voters are seeing first-hand what money can buy. Tens of...

-

Politics

Biden signs gun control bill in wake of deadly mass shootings: ‘Lives will be saved’

Less than 24 hours after it passed through the Congress with unusual speed, President Biden signed...

-

Politics

Trump’s Vanity Could end up being a Major Gift to Jan. 6 Committee

We could soon find out if Trump and his family’s thirst for attention helped a filmmaker...

-

Politics

CBS News obtains images from documentary film footage given to Jan. 6 panel

The House select committee looking into the attack on the U.S. Capitol on January 6, 2021,...

-

Politics

Here is what Bill Clinton said in response to Donald Trump in “Late Late Show With James Corden”

When questioned on a late-night talk show, one former president made a jab at another former...

-

Politics

Joy Behar Had Few Words for Donald Trump’s White House Staff and Mike Pence on ‘The View’ Latest Episode: ‘Don’t Try and Fool Us’

On the most recent episode of The View, Joy Behar had a few words for Donald...

-

Politics

Trump’s Team Setting Up Eastman to Take Blame for Jan. 6

Trump in recent weeks has told confidants that he sees no reason to defend the lawyer...

-

Politics

Pence says he won’t let Dems use Jan. 6 ‘to distract’ from their ‘failed agenda’

Pence said he and Trump parted amicably, but that they have gone their separate ways. Former...

-

Politics

Texas GOP’s election denial underscores the ongoing threat that’s the central message of the Jan. 6 hearings

Last week, during a select committee hearing on January 6, the star witness warned that Donald...

-

Politics

Hillary Clinton Rules Out 2024 Bid: “I expect Biden to run”

‘I expect Biden to run… It would be very disruptive to challenge that…’ Hillary Clinton, a...

-

Politics

Barack Obama posts pic with Michelle, Malia, and Sasha on Father’s Day

Barack Obama celebrated Father’s Day by dropping an adorable picture featuring his wife, Michelle Obama, and...

-

Politics

President Biden Falls During Bike Ride: “I’m Good!”

Just as he rounded the corner to approach the pack, who wished him a happy Father’s...

-

Politics

Trump ‘Induced Murderous Rage’ In Insurrection Mob: It was “as dark as it gets”

They were ready to “tear Pence limb from limb.” It was “as dark as it gets,”...

-

Politics

Bill Clinton Gives Down-Home Advice On Persuading Other Side: “We gotta reach people where they live”

The former president offered tips on advocating for reasonable gun control on “The Late Late Show.”...

-

Politics

Hunter Biden’s ex-wife knew nothing of tax trouble: ‘I had buried my head in the sand’

Buhle claimed to have ‘buried [her] head in the sand’ about Hunter Biden’s financial ties to...

-

Politics

The January 6 committee calls Trump out for using false claims of election fraud to scam supporters

Committee says Trump campaign knew claims of election fraud were false but used them to raise...

-

Politics

Michelle Obama urges Voters to Stay Engaged in Anxious Times: “Our democracy is fading”

Michelle Obama urged Americans not to tune out of the nation’s stalemate political system on Monday,...

-

Politics

What to expect from the second Jan. 6 committee hearing: the committee will provide a “great deal”

On Monday, two panels of in-person witnesses will testify in front of a House committee probing...

-

Politics

Taking Aim at DeSantis, Trump Considers Launching 2024 Bid in Florida

In recent months, Donald Trump has told confidants that he may launch his presidential campaign for...

-

Politics

Trump Trapped By ‘Ego’ In 2020: “He can’t admit his tweeting and narcissism turned off millions”

The newspaper controlled by longtime Trump backer Rupert Murdoch called Jan. 6 “national shame” and ripped...

-

Politics

Ex-Obama Aide David Axelrod SKEWERS Joe Biden: “The presidency is a monstrously taxing job”

One of President Barack Obama‘s most trusted advisers has come out against President Joe Biden, the...

-

Politics

Arnold Schwarzenegger Revealed Donald Trump’s Hypocrite Behaviour Towards Him After One Phone Call: “Very Mean-Spirited”

Celebrity feuds are an exciting conflict to watch for people because of the recent social media...

-

Politics

‘Breaking’ Story About Biden Mtg In 2 Days Just Appeared On Trump’s Truth Social Account. True or False?

This was just posted on Twitter. I’m sharing it with the caveat that it’s likely that...

-

Politics

Report: Donald Trump to Testify In New York Probe Over Alleged Fraud In July

As per the lawsuit, NY State Attorney General Letitia James must complete her questioning by the...

-

Politics

No easy ride for Biden as Kimmel tells him to ‘start yelling at people

Serious questions on gun violence mean there are few laughs as US president meets late-night TV...

-

Politics

Biden’s ‘Childhood Stutter’ Excuse Comes Under Scrutiny

‘One of [Biden’s] aides gingerly asked whether I’d noticed the former vice president stutter during the...

-

Politics

Scandal-plagued Obama AG Makes Strange Prediction About America’s Future

Harold Hutchison on June 6, 2022. In a Monday interview, former Attorney General Eric Holder predicted...

-

Politics

Jill Biden was criticized for using foul slang in an interview

Jill Biden, M.D. While discussing her marriage with President, she inadvertently uttered a slang phrase with...

-

Politics

Former President Donald Trump To Terrorize Nation With 2024 Announcement Soon

Some advisers say it could come as early as this summer. If you lived from 2016...

-

Politics

Kyle Rittenhouse posts a video of himself firing off bullets from an automatic firearm: ‘Joe Biden, you’re not coming for our guns’

Kyle Rittenhouse tweeted a video on Monday showing himself firing what seemed to be an automatic rifle while telling President Joe Biden that he couldn’t take Americans’ guns away. Rittenhouse tweeted the video with the comment, “Come and take ’em, Joe.” The video appeared to show Rittenhouse unleashing a barrage of shots from an automatic rifle at a shooting range, as Yahoo reported. Rittenhouse offers a thumbs up after moving back from the pistol and being patted on the back and says, “Joe Biden, you’re not coming for our guns.” In August 2020, Rittenhouse fatally shot two individuals and injured a third during protests in Kenosha, Wisconsin. In November, he was cleared of five charges, including first-degree homicide. Biden urged government action on gun reform...

-

Politics

Trump is moving from Mar-a-Lago to New Jersey for the summer

Former President Donald Trump is leaving Florida to avoid the summer storms. According to a Republican...

-

Politics

Memphis City Council refuses to give Trump security: “He’s notorious for not paying”

Former President Donald Trump is scheduled to hold a campaign rally in Memphis, but the city...

-

Politics

Ex-Prosecutor Says Peter Navarro Bust Likely Warning To Trump Cronies DOJ Isn’t ‘Fooling around’

A former federal prosecutor said Saturday that the no-frills FBI arrest of Donald Trump‘s former trade...

-

Politics

Trump’s plans for summer include 7-hour grilling in his fraud case

Donald Trump and three of his children agreed to testify under oath for up to seven...

-

Politics

Biden Calls On Congress to Reinstate Federal Assault Weapons Ban and New ‘Red Flag’ Laws

On Thursday night, President Biden set out his gun-control agenda, stating that the policies he proposed...

-

Politics

Biden Blanks during Coast Guard Changing Of the Guard Ceremony, While CNN Captures Classic Fail Moment

On Tuesday, Joe Biden‘s brain was not functioning properly. During the Coast Guard changing of the...

-

Politics

Herschel Walker accuses Donald Trump of lying: “So, I’m mad at him”

“I’m mad at [Trump], because he never asked, but he’s taking credit that he asked.” Many...

-

Politics

Why Donald Trump Isn’t to Blame for America’s Toxic Political Tribalism

The man who wrote the definitive work on how Americans have become splintered by their politics...

-

Politics

Hunter Biden’s Shady Business Associates Frequently Visited White House, $5.2 Million for ‘the Big Guy’ Discovered

Hunter Biden’s business ties to his father Joe Biden’s administrations are becoming more clear, as his...

-

Politics

Ted Cruz Got Heckled At Houston Restaurant Following His Speech at NRA Convention in Which He Broadly Rejected Proposals for Gun Control Days after Uvalde School Shooting

Following the gun massacre in Uvalde, Texas, which claimed the lives of 19 children and two...

-

Politics

Kamala Harris calls for a ban on assault weapons: “An assault weapon is a weapon of war”

Vice-president demands action after speaking at funeral for Ruth Whitfield, oldest person killed in Buffalo shooting...

-

Politics

McCarthy escalates standoff with January 6 panel over subpoena: “I expressly reserve Leader McCarthy’s right to assert any other applicable”

Republican Leader Kevin McCarthy has made it clear that he will likely decline to appear in...

-

Politics

Donald Trump’s Media Company Plans to Build New Streaming Service ‘TMTG+’ As ‘Non-Woke Alternative’ To Netflix and Disney+

In a recent SEC filing, Donald Trump‘s media and technology firm stated that it will build...

-

Politics

Texas Gunman Left Home after Fight with Mom about Wi-Fi: “He was kind of a weird one”

The man who opened fire in a Texas elementary school Tuesday, killing 19 children and two...

-

Politics

Whoopi Goldberg criticizes audiences of ‘The View’ for booing Kellyanne Conway

Whoopi Goldberg, co-host of ABC’s “The View,” chastised studio audience members on Tuesday for taunting former...

-

Politics

‘The View’ Hosts Make Fun of Ted Cruz’s ‘Creepy’ Rage Over Pete Davidson’s Love Life

Ted Cruz’s concern about Pete Davidson’s love life amuses and disgusts the hosts of “The View.”...

-

Politics

Washington Post-Ipsos Poll Says 75 Percent of Black Americans Fear Being Physically Attacked Because of Race

According to a new poll, 75% of Black Americans are concerned that they or a loved...

-

Politics

Trump fined $110,000 for Obstructing Tax Inquiry

Former US President Donald Trump has paid a $110,000 (€104,000) fee for obstructing a significant tax...

-

Politics

Texas Supreme Court Grants Partial win to Transgender Children

The Texas Supreme Court criticized the state’s governor and attorney general last week for circumventing conventional...

-

Politics

Melania Trump Talks about Her Critics and More in Her First Sit-Down Interview Since Leaving White House: “People I See Always Criticize Me”

Melania Trump gave her first sit-down interview since leaving the White House on Fox News on...

-

Celebrities

Former US First Lady Melania Trump Gives Explosive New Interview since leaving the White House

The former First Lady of the United States has given her first interview since leaving the...

-

Politics

Biden administration announces a $45 billion plan to connect the entire U.S to the internet by 2030

The Internet for All initiative is funded by the $1 trillion Bipartisan Infrastructure Law. The Biden...

-

Politics

Senate Democrats’ Bill to keep Abortion legal in the U.S Fails due to a GOP-led Filibuster

Sen. Joe Manchin joined all Republicans in voting to block the legislation, which Democrats want to...

-

Politics

Hunter Biden’s Tax Bill Supposedly Settled With $2 Million Loan from Hollywood Lawyer

Hunter Biden‘s tax issues were supposedly settled with a $2 million loan from a Hollywood lawyer...

-

Politics

Trump blamed Defense Secretary for Failing to Invoke Insurrection Act during BLM Riots: “You betrayed me”

‘Mark Esper was a stiff who was desperate not to lose his job… ‘ According to...

-

Politics

Jill Biden Pays Tribute to ‘Resilient’ Ukrainian Moms on Mothers’ Day: “Ukrainian Mothers, Like Svitlana, Continue to Be So Strong and Resilient”

“We stand with you,” Jill Biden said in a message to the families. She also thanked...

-

Politics

Kamala Harris Cautions That Women May Lose Right to “Make Decisions about Their Own Bodies” In Graduation Speech at Tennessee State University

Kamala Harris also cautioned graduates of Tennessee State about Russian aggression. In her graduation speech at...

-

Politics

Study claims: Trump Supporters Use less Cognitively Complex Language and think in more Simplistic ways than Biden Supporters

According to new research published in the Journal of Social Psychological and Personality Science, Trump supporters...

-

Politics

Biden Slams GOP’s “Extreme” MAGA Agenda

In advance of the Midterm elections, the president, who ran on bipartisanship, takes off the gloves....

-

Politics

Bipartisan group urging House not to tie aid to Ukraine to COVID-19 funding: “Your fight is a fight for everyone”

A bipartisan group of U.S. military veterans in Congress has called on U.S. House Speaker Nancy...

-

Politics

Trump and his allies to campaign for Herbster at I-80 Speedway

A rally planned for Friday night in Greenwood in support of Charles Herbster’s bid to become...

-

Politics

Boeing CEO Dave Calhoun believes the company should have avoided Trump-era Air Force One deal: “Art of the Deal”

Boeing CEO Dave Calhoun told investors on Wednesday that the company should not have agreed to...

-

Politics

Florida can’t Dissolve the Special Tax District until the debt is Fully Paid: Disney Claims

The Reedy Creek special district made a statement last week indicating it would conduct business as...

-

Politics

Greene’s Text Messages Refocused Attention on his Martial Law Testimony

In a January 2021 text, Greene told Trump’s chief of staff that some lawmakers wanted the...

-

Politics

Federal Judge Temporarily Stopped Administration of President Joe Biden from Lifting Title 42 Covid Border Restrictions for Migrants

A federal judge in Louisiana has temporarily blocked the Biden administration from lifting a Trump-era pandemic...

-

Politics

Trump says Prince Harry is “whipped” by Meghan Markle and the queen should have stripped them of their titles

Piers Morgan’s blockbuster interview with Donald Trump will air tonight in the UK, and the former...

-

Politics

Florida’s Disney district crackdown may violate the First Amendment: ‘highly likely to be unconstitutional’

One law professor said if the bill was a direct result of Disney’s political speech, it’s...

-

Politics

Man dies after setting himself on fire outside the Supreme Court Building

A climate activist who set himself on fire outside the United States Supreme Court Building on...

-

Celebrities

Donald Trump Issues Statement Following ‘Piers Morgan Uncensored’ Interview Storm Out

After walking out of Piers Morgan’s new talk show, Donald Trump has spoken out. It’s only...

-

Politics

Hillary Clinton filed a motion to dismiss Trump’s Lawsuit against her as having “no merit”

Hillary Clinton filed a motion on Wednesday seeking to dismiss former President Donald Trump’s lawsuit against...

-

Politics

Psaki Extends Doocy Feud As Biden Prepares To Appeal Mask Ruling, Doocy Dared To Challenge Inconsistencies of Biden Administration’s Mask Mandates

Psaki Extends Doocy Feud As Biden Prepares To Appeal Mask Ruling, Doocy Dared To Challenge Inconsistencies...

-

Politics

Department of Education Announce Changes: Millions of Individuals Closer to Student Debt Forgiveness under New Biden Administration

The Department of Education announced changes on Tuesday that are expected to bring millions of individuals...

-

Politics

Christian Music on Plane sparks outrage and Ilhan Omar is Criticized for Mocking a Video

People have criticized Minnesota Rep. Ilhan Omar for mocking a video of plane passengers singing. To...

-

Politics

Pelosi Drags Latinos Under the Bus in Battleground District

‘There’s all this talk about Latino voters, but where are we talking about Latino candidates and...

-

Politics

McCarthy thinks Biden should have helped Ukraine sooner, despite Trump’s decision to withhold aid from the country in 2019

House Minority Leader Kevin McCarthy said Russia “probably” would not have invaded Ukraine if the US...

-

Politics

Rep. Upton of the Republican Party criticizes the ‘MTG Element,’ claims they make it ‘hard’ to govern

Representative Fred Upton, a Republican from Michigan, slammed the “MTG element,” referring to Republican Representative Marjorie...

-

Politics

Democrats and Biden are in Election Trouble Because the Reliable Hispanic vote is in Jeopardy: “We’ve just got to do it.”

Despite a string of poor polls, current polls show that President Joe Biden is having a...

-

Politics

Former First Lady Melania Trump pushed Donald Trump to support Dr. Oz in the Pennsylvania Senate Race

According to a story, former First Lady Melania Trump reportedly pushed her husband, former President Donald...

-

Politics

President Biden Announces Crackdown on ‘ghost guns,’ Reveals new ATF Pick

Recently, President Joe Biden and his ATF lackey declared new gun control rules, concerning so-called “ghost...

-

Politics

Ukrainians’ ‘last stand’ to battle for Mariupol as the city expected to ‘fall within 24 hours’ to Russia

The beleaguer and the strategic port city of Mariupol are looking to fall to Russian hands...

-

Politics

Ex-President Donald Trump Just Made an Absolutely Head-Scratching Endorsement

Donald Trump held a gathering/ demonstration in North Carolina on Saturday night, but it unusual theatrics...

-

Politics

Psaki denied giving the reason why Biden Wrote College Counsel Letter for Chinese Businessman’s Son

During a White House meeting Wednesday, Press Secretary Jen Psaki denied giving reasons why President Biden...

-

Politics

Secret Service is Taking Charge $30,000-a-Month Malibu Mansion to Safeguard Hunter Biden

President Biden’s remaining son, Hunter Biden, is living in a rented four-bedroom “resort-style” home in Malibu,...

-

Politics

Ivanka Trump Not ‘Talkative’, But Helpful In Jan. 6 Probe

Ivanka Trump gave evidence before the Jan 6 on Tuesday. 6 committees that I inquired about...

-

Politics

Mike Lindell, CEO of MyPillow, claims that TV stations refused to let him appear in his commercials

Mike Lindell, the CEO of MyPillow, claims that he has been barred from appearing in many...

-

Politics

Biden wants to Make Obamacare Subsidies available to More Households

According to a rule proposed by the Biden administration on Tuesday, more families will be eligible...

-

Politics

President Zelensky Made a Speech at the 2022 Grammy Awards

The 44-year-old Ukrainian president – whose country is agonizing an existing military seizure launched by Russian...

-

Politics

Hillary Clinton says ‘More’ can be done to hurt Putin, help Ukraine: ‘Double down’

Prior Secretary of State Hillary Clinton on Sunday called on the U.S. and its allies to...

-

Politics

In the Midst of Economic Crisis, Biden’s Budget Invests Nearly $40 Billion to Fight Global Climate Change

‘The Biden budget has one-sixth of a page on the opioid epidemic followed by six pages...

-

Politics

Gaetz Enters ‘Laptop From Hell’ Into Congressional Record After Nadler Rescinds Objection

Has the FBI assessed whether Hunter Biden’s laptop could be a point of vulnerability, allowing America’s...

-

Politics

Trump likely to have Committed Election-related Crimes: Judge Asserted “more likely than not”

A federal judge has asserted it is “more likely than not” that former President Donald Trump...

-

Politics

Video: War Between Russia and Ukraine Turns Kharkiv Metro into a Bomb Shelter

Since the start of the invasion, Russian forces have shelled Kharkiv’s residential structures and essential infrastructure....

-

Politics

Ukrainian Politician Says Country Will Not Remain Silent about ‘Horror of Rapes’ Against Women during Invasion

According to a Ukrainian legislator, Ukraine would “not be silent” about the “horror” of rapes committed...

-

Politics

Dr. Jill Biden has Devised new Rules in preparation for a White House

With these New Rules, Dr. Jill Biden gets even pettier: she felt “second class” Dr. The...

-

Politics

A New Poll adds to Good news for GOP and Trump in Years 22, 24

A new Emerson University polling shows lots of good news for Republicans in the run-up to...

-

Politics

President Joe Biden Will Visit Poland on Europe Trip This Week

As Russian forces concentrate their fire on cities and trapped residents in a nearly month-old invasion...

-

Politics

Khalid Payenda’s Journey from Afghan Finance Minister to Uber Driver in Washington

Khalid Payenda told The Washington Post he has been haunted by the fall of Afghanistan to...

-

Politics

Hillary Clinton Joins Call on Twitter to ‘Free Brittney’ After Brittney Griner’s Arrest in Russia

Hillary Clinton has joined the call to bring home Phoenix Mercury star Brittney Griner. Following Griner’s...

-

Politics

President Joe Biden references Vladimir Putin as a ‘war criminal’

It is the first time the US President has used the remark in reference to Mr....

-

Politics

Donald Trump’s close friend and New York Jets owner, Woody Johnson wants to buy Chelsea

Woody Johnson is one of the numerous parties to emerge as potential owners of Chelsea, with...

-

Politics

British Residents Who Take In Ukrainian Refugees into Their Homes Will Receive Large Monthly Payment

The payment will be made as a “thank you” to those who have shown their support....

-

Politics

Trump Lawyer Knew That Plan To Postpone Biden Certification Was Illegal, Emails Show

Despite the fact that the scheme was in violation of the Electoral Count Act, John Eastman...

-

Politics

Psaki and DeSantis official clash over a Covid vaccine recommendation for healthy children: “Absolutely not. … We know the science”

Jen Psaki, the White House press secretary, criticized Florida surgeon general Joseph Ladapo’s advice that healthy...

-

Politics

Russian spy says Ukraine war will be a ‘total failure,’ with a ‘collapse similar to fall of Nazi Germany’

A whistleblower described the war as a “total failure” that could only be compared to Nazi...

-

Politics

Elon Musk Tells Ukrainian President Zelensky More SpaceX Internet Stations are On the Way

It appears that in this more and more troubled world, all roads lead to Elon Musk,...

-

Politics

First Lady Jill Biden introduces Kamala Harris as ‘the president,’ then says she was joking

Although it isn’t the first time Kamala Harris has been referred to the President, the American...

-

Politics

Donald Trump, who has a Long History of Criticising NATO now Claimed Credit for its Existence

Former President Donald Trump, who has a long history of criticizing the North Atlantic Treaty Organization...

-

Politics

“Problem Is Not That Putin Is Smart, But Our Leaders Are So Dumb”: Trump

Donald Trump made an appearance at the CPAC Republican Convention Even though he is currently killing...

-

Politics

Oil Prices Jump, Shares Falls as Ukraine Crisis Escalates

After Russian President Vladimir Putin recognized the independence of rebel-held regions of Ukraine, oil prices about...

-

Politics

First Lady Dr. Jill Biden is Redecorating Her East Wing Office with Mark Sikes: where she can hold larger meetings and host guests

The first lady’s office says the “project will be funded through donations to the White House...

-

Politics

Fox News Contributor admits to Fabricating a Story about Canadian woman being Trampled to Death

During ongoing trucker-led protests, Fox News contributor Sara Carter has pulled back her entirely fictitious story...

-

Politics

Joe Biden and Vladimir Putin Agreed to Meet over Ukraine Crisis on the Condition

Russia-Ukraine Crisis: The summit, proposed by France’s Emmanuel Macron, will be expanded to relevant stakeholders to...

-

Politics

Republican-controlled Florida House Passes a 15-week Abortion Ban

Republicans in Florida’s House of Representatives approved a 15-week abortion ban early Thursday, tightening access to...

-

Politics

The ‘Truth Social’ of Donald Trump Has Been Revealed—It Looks Almost Identical to Twitter

Donald Trump Jr. has shared online what is believed to be a screenshot of his father’s...

-

Politics

Hillary Clinton pushed Trump-Russia theory at the center of John Durham Case

Former President Donald Trump accused Hillary Clinton’s campaign operatives of spying on him and suggested they...

-

Politics

Trump Used Secret Service Agent’s Phone to Contact his Wife after Being Accused of Adultery

After being accused of adultery by the adult movie star, former US President Donald Trump used...

-

Celebrities

Katharine McPhee Criticizes Stacey Abrams for Photo without Mask with Schoolchildren: ‘The Hypocrisy Continues’

Despite a requirement, Katharine McPhee joined Stacey Abrams’ opponents in criticizing her for posing without a...

-

Politics

Palin v. New York Times Raises Concerns about Media Libel Laws

“The 360” shows you diverse perspectives on the day’s top stories and debates. The defamation case...

-

Politics

Fauci Declares ‘Full Blown’ Pandemic Phase Of Covid-19 Is Almost Over In US

Over the last three weeks, the number of persons in hospitals with COVID-19 has decreased by...

-

Politics

A new report adds to the mystery surrounding Melania Trump’s recent NFT auction

Vice reported on Tuesday about a strange series of transactions surrounding the auction for former First...

-

Politics

White House blasts Florida Republicans for their ‘Don’t Say Gay’ Bill

The White House has chastised the Florida Republican Party over legislation dubbed the “Don’t Say Gay”...

-

Politics

Trump illegally ripped up ‘hundreds’ of documents despite warnings, many of which were destroyed in ‘burn bags’

The Washington Post reported Saturday that former President Donald Trump tore up “hundreds” of White House...

-

Politics

Gaetz Friend Requests Judge For Sentencing Delay As He Works With Feds

A former Florida tax collector whose arrest led to a federal investigation into U.S. Rep. Matt...

-

Politics

Leaked documents raise new concerns about Biden administration’s preparations for withdrawal from Afghanistan: Report

On Tuesday, the Biden administration’s handling of the withdrawal from Afghanistan came under new scrutiny after...

-

Politics

Senator Lindsey Graham Mocked By Critics After Trump Turns On Him

Senator Lindsey Graham (R-SC) was mocked on Tuesday by his critics after his years of allegiance...

-

Politics

Paper Tantrum? Documents Subpoenaed by 6 Jan. Trump Reportedly Torn Panel

The documents were obtained by the 6 January Committee after a lengthy legal battle with the...

-

Politics

Democrat Workers Turn on Nancy Pelosi, Charles Schumer in Surprising New Survey

According to a surprising new survey, the vast majority of Democrat workers on Capitol Hill appear...

-

Politics

Pence’s Chief of Staff Marc Short Met With Jan 6th Committee

Marc Short, former Vice President Mike Pence’s chief of staff, has answered questions from the House...

-

Politics

What Does Kamala Harris’s Interview Responses Actually Mean? Body Language Expert Reveals

What Does Kamala Harris’s Interview Responses Actually Mean? Body Language Expert Reveals It is claimed that...

-

Politics

If prosecutors investigating him ‘do anything illegal,’ Trump threatens a “biggest protest we have ever had” in Washington, DC, and other cities

Former President Donald Trump called for nationwide protests at a rally in Texas if prosecutors investigating...

-

Politics

Donald Trump Stated that if he is re-elected President in 2024, he will Pardon Capitol Rioters

Former US president Donald Trump has promised to pardon the Capitol rioters if he makes it...

-

Politics

Sarah Palin Talks About Her Second COVID-19 Diagnosis

Sarah Palin said she felt “totally fine” in her first interview since contracting COVID-19 again on...

-

Politics

Trump Mocked for an Embarrassing ‘Please Clap’ Moment at his own Resort

The former president seemed to need some adulation at Mar-a-Lago. Donald Trump might have had his...

-

Politics

Trump Dismisses Rumors Of Feud with DeSantis: ‘We Have A Good Relationship’

Former President Donald Trump dismissed reports of a growing feud between himself and Florida Gov. Ron...

-

Politics

All of Biden’s successes or failures, it’s really about ‘COVID, stupid’

President Biden held a nearly two-hour, wide-ranging news conference on Wednesday that, for all of its...

-

Politics

Riley Roberts is Alexandria Ocasio-longtime Cortez’s Partner whom She Met in College

Alexandria Ocasio-Cortez, a New York Representative, is known for making headlines, whether for her strong opinions...

-

Politics

Gaetz’s ex-girlfriend is Granted Immunity in S*x Trafficking Investigation

The sex trafficking case against Rep. Matt Gaetz (R-FL) is surging after it was revealed on...

-

Politics

Trump Claims that White People are Discriminated against when it comes to COVID-19 Treatment: ‘If you’re white, you go to the back of the line’

Former President Donald Trump claimed on Saturday during a rally in Florence, Arizona, that white people...

-

Politics

Melania Trump’s Item Auction Is ‘Basement-Level Tacky…She Needs Money,’ Says ‘The View’ Hosts

The ladies of The View have slammed Melania Trump‘s recent antics. The former First Lady has...

-

Politics

Candace Owens promotes a vaccine conspiracy theory in connection with Bob Saget’s death

Candace Owens, a far-right troll, suggested on Tuesday that beloved comedian Bob Saget may have died...

-

Politics

Donald Trump Cut NPR Interview After His “Rigged” Election Idea Debated

When the main focus is on Donald Trump, he can’t even handle it. Trump appeared on...

-

Politics

Congresswoman Requests Capitol Police Help While Expressing ‘Concerns’ About Rep. Greene’s ‘Mental Health’

Rep. Haley Stevens (D-MI) has asked for help from Capitol Police after Rep. Marjorie Taylor Greene...

-

Politics

Hunter Biden’s ‘Close Friend’ Arrested in Kazakhstan For Treason

In one meeting, which took place in Kazakhstan, Hunter Biden ditched his Secret Service security detail...

-

Politics

What Is Voting Rights Filibuster? New Agenda of Joe Biden

US Senate: The popular perception of a filibuster involves a lone senator speaking for hours and...

-

Politics

Biden will take a “forceful” Push for Voting rights and Filibuster Reform in his Speech in Georgia

With less than 10 months until the 2022 midterm elections, President Joe Biden will travel to...

-

Politics

Romney Defends Biden’s 2020 win after Trump Criticizes the GOP’s Rounds

Following an attack by former President Donald Trump, Republican Senator Mitt Romney of South Dakota defended...

-

Politics

Michelle Obama’s guest appearance on ‘Black-ish’ excites fans

Michelle Obama made a guest appearance on Tuesday’s eighth and final season premiere of Black-ish, after...

-

Politics

With the help of your tax return, get $1,400 in stimulus checks

Taxpayers can receive up to $1,400 in stimulus checks through their tax returns at the start...

-

Politics

Lauren Boebert Comes to Marjorie Taylor Greene’s Help After Twitter Ban, And Things Don’t Go Well

Rep. Lauren Boebert (R-Colo.) caused outrage with her threatening reaction to Twitter’s suspension of fellow far-right...

-

Politics

Stephen Colbert Reveals Unseen Trump Footage From January 6th That He Hopes Will Be Released Next

Stephen Colbert expected that the world would soon see what Donald Trump was up to during...

-

Politics

CNN Opinion Columnist: ‘Let’s Go Brandon’ Dad Deserves To Have Life Ruined

‘Apparently, he thinks he should be able to tell Biden to basically go fk himself while...

-

Politics

Joe Biden criticizes Evils of Big Meat in Bizarre, Senile Performance

This morning, RedState reported on Joe Biden’s plan to avoid blame for the nation’s inflation crisis,...

-

Politics

Members of House Select Committee Verifies Communications between Ivanka and Donald Trump during Capitol Siege, Says They Have “Critical Testimony” About Interactions

Members of the House Select Committee looking into the deadly Capitol insurgency on January 6th stated...

-

Politics

Jen Psaki’s Favourite Phrase Could Be Banned Soon

According to Lake Superior State University‘s renowned annual list of banned terms, there should be no...

-

Politics

Trump Slams Comcast and NBC Executives as “Terrible Human Beings…just disgusting”

Former President Donald Trump appeared on the conservative YouTube channel Right Side Broadcasting and expressed his...

-

Politics

Melania Trump Records Kids’ Birthday Messages and Wrote Inspirational Letter to High School Students

• She has grandparent responsibilities to her stepchildren Ivanka, Eric, and Donald Jr., but she’s also...

-

Politics

Bill Clinton Story 2021: Getting $120 Million Divorce After Health Crisis

Is Invoice Clinton planning to divorce Hillary? Though the tabloids spread multiple rumors about the Clintons...

-

Politics

‘Who gives a f***,’ Melania Trump Said in a Foul-mouthed Christmas Rant

During her four years in the White House, Melania Trump received a lot of backlash for...

-

Politics

Trump’s spokesman says that he has cooperated with House panel investigating events of January 6th

In a court filing on Friday, a current spokesman for former US President Donald Trump said...

-

Politics

Staffers working under Biden are considering leaving the White House due to “poor management”

According to confidential and anonymous conversations with Biden White House staffers, Politico’s West Wing Playbook says...

-

Politics

Pelosi frustrated by chants of “Let’s Go Brandon” in her own far-left district

Fox News reported swamp monster and career politician, Nancy Pelosi, D-Calif., was overwhelmed by her own...

-

Politics

Biden claims that Americans are better off than they were years ago

The desperate Brandon administration attempted to convince Americans that, despite overwhelming evidence to the contrary, they...

-

Politics

Joe Biden gets double hit from Manchin and another Covid winter

Democratic Sen. Joe Manchin dropped the ax on his party’s agenda on Sunday, saying he would...

-

Politics

South Dakota Governor Kristi Noem holds push to Prohibit Transgender Women and Girls from Engaging in Female Sports

South Dakota Governor Kristi Noem announced on Tuesday that she has proposed legislation in her state...

-

Politics

‘Why Is Anybody Surprised?’ Democratic Congressman Rips ‘Traitor’ Jim Jordan Over Jan. 5

Rep. Jim Jordan has marked a “traitor to the Constitution” by Rep. Ruben Gallego (D-Ariz) after...

-

Politics

Liz Cheney raised the possibility of Trump election crime

Andrew McCabe, the former deputy director of the FBI, and David Williams, the former inspector general...

-

Politics

Federal Court Will Consider Overturning Injunction against Joe Biden’s Vaccination Mandate

‘While I would have much preferred that requirements not become necessary…’ (The Center Square) – A...

-

Politics

Trump Rally Features ‘Many Empty Seats’ — Prompting Organizers to Close Arena’s Top Level

On Saturday, organizers had to close the top bowl of the arena because there were so...

-

Politics

Piers Morgan tells Hillary Clinton to let it go! Trump Loss Meltdown after 2016

Earlier, an emotional ex-presidential candidate Hillary Clinton almost turned on the waterworks while reading her would-be...

-

Politics

Sunrise’s Co-Host Natalie Barr Shares her Embarrassing Story about Phone Call With the ‘Well-Hung Guy’

On Wednesday, Natalie Barr, co-host of Sunrise, told the team a hilarious story about a recent...

-

Politics

Stacey Abrams is still Lying about the Georgia Election, she Refused to Accept Defeat

‘Concession means to acknowledge an action is right, true, or proper…’ Stacey Abrams, a failed gubernatorial...

-

Politics

Will Epstein’s Rich & Powerful Friends Be Revealed in the Maxwell Trial, or Will It Be Another Cover-Up?

On November 29, the trial of convicted sex offender Jeffrey Epstein’s close confidant Ghislaine Maxwell starts....

-

Politics

Biden Launching Urgent Campaign for Americans to Get COVID-19 Booster Shots

Private insurers will be required to cover the cost of at-home Covid-19 tests, and testing procedures...

-

Politics

As Joe Biden Snubs Hungary, Viktor Orbán Fears Election Interference

The Hungarian government voiced concern that the US would try to intervene in their elections after...

-

Politics

House Panel Subpoenas Trump supporters Roger Stone and Alex Jones in Capitol Riot Inquiry

A committee looking into the US Capitol insurgency has subpoenaed five more people, including former President...

-

Politics

AOC Claims It Was A ‘Mistake’ For Dems Not to Ask For Her Help in Va. Elections

Not a single person asked me to send an email, not even to my own list…’...

-

Politics

Biden Mocked For ‘Ron Burgundy’ Moment after Sticking to Script in Speech

According to right-wing critics, US President Joe Biden had a ‘Ron Burgundy’ mix-up with a teleprompter. ...

-

Politics

Bill Maher Rejects Critical Race Theory, Claiming That Racism Isn’t In America’s DNA

Bill Maher, a comedian, and television host expressed sympathy for parents’ concerns over critical race theory...

-

Politics

Biden Administration Offering more Aid for Winter Heat, Utility Bills

The Biden administration is taking steps to help distribute several billion dollars in winter heating and...

-

Politics

President Biden says reversing High Inflation “Top priority” As US Prices hit 30-years High

President Joe Biden has said that fighting inflation in the United States is his “top priority”...

-

Politics

Log Cabin Republicans Move their Annual Gala to Florida to Honour Melania Trump

Donald Trump is expected to attend the Log Cabin Republicans’ annual Spirit of Lincoln dinner, which...

-

Politics

Kellyanne Conway Returns with Her Most Brazen Trump Lie Yet

Former Counselor to the President of the US Kellyanne Conway resurfaces on Fox News to attack...

-

Politics

President Biden Repeatedly Claims he’ll be in ‘trouble’ for Taking Press Questions

Following remarks about the passage of the $1.2 trillion infrastructure bill, President Biden warned he would...

-

Politics

Chinese Tennis Star Peng Shuai Claims China’s Former Vice Premier Forced Her into S*x

Peng Shuai, the former world No. 1 tennis doubles player, claimed in a Weibo post that...

-

Politics

House Democrats restored paid family leave in the social safety net bill after Biden removed it to please the right-wing

Nancy Pelosi, US House Speaker, announced changes in a Wednesday letter to her colleagues, saying it...

-

Politics

Glenn Youngkin Republican beats McAuliffe for the governorship of Virginia

Republican Glenn Youngkin defeated Democrat Terry McAuliffe in Virginia’s gubernatorial election Tuesday night, striking a political...

-

Politics

Biden Apologizes to World Leaders for Trump’s Exit from Paris Accords at COP26

President Joe Biden was criticized on Monday after he seemed to close his eyes and nap...

-

Politics

Is This Biden Policy is About to Create another National Crisis

Biden is good at one thing: performing a terrible job, and he’s about to create another...

-

Politics

Ex-New York Governor Andrew Cuomo Charged With Misdemeanor S*x Crime

Former New York Governor Andrew Cuomo has been charged with a sex crime in Albany City...

-

Politics

Florida Sues Biden, NASA over “Unlawful” COVID-19 Vaccine Mandates for Federal Contractors

A lawsuit claims that a federal rule interferes with Florida’s employment policies. President Biden, NASA, and...

-

Politics

Jen Psaki Bombs Christian Reporter Who Compared Abortion to ‘Hiring a Hitman’ ‘I Answered Your Question’: WATCH

It’s always interesting to see reporters try to one-up White House Press Secretary Jen Psaki as...

-

Politics

Is Kamala Harris Keeping a safe Distance from Biden as his Popularity Plummets?

The poll results continue to give a clear picture of the American people’s feelings toward Joe...

-

Politics

Merrick Garland denies Republicans access to January 6 records – Tells them to go beg Nancy Pelosi

The Department of Justice, led by openly partisan Attorney General Merrick Garland, has advised House Republicans...

-

Politics

Prince Andrew’s Lawyer Wants to Keep 2009 Legal Deal Sealed

Virginia Giuffre, the royal’s accuser, sued millionaire Jeffrey Epstein and his life partner Ghislaine Maxwell in...

-

Politics

State Department will Establish a new Cyberspace Bureau to Tackle Online Attacks

Changes are part of the Biden administration’s approach to cybersecurity as a critical national security issue....

-

Fitness

Fauci Under Fire For Alleged Puppy Experiments That Saw Beagles Kept In Cage To Be Eaten By Hungry Sandflies

DR. Anthony Fauci has come under criticism for allegedly supporting research in which beagle puppies were...

-

Politics

What’s Behind the Push for a Fourth Stimulus Payment

The IRS distributed more than 169 million payments in the third round of direct stimulus aid,...

-

Politics

Congressional Investigators Found The Trump Administration Used Its Food Aid Program for Political Gain

A $6 billion federal program created to give fresh food to families affected by the pandemic...

-

Politics

CNN’s journalist, John King announces he’s been battling MS for years live on air

John King, a CNN journalist known for his in-depth election night coverage, revealed for the first...

-

Politics

Liz Cheney Approaches GOP Colleagues Ahead of Bannon Contempt Vote: ‘You All KNOW’ Election Fraud Claims Are False

Liz Cheney, the U.S. Representative for Wyoming, sent a strong signal to her Republican colleagues on...

-

Politics

Trump to be Deposed in a Lawsuit Filed by Protestors Claiming Assault by his Security Guards

Former President Donald Trump is ordered to submit testimony next week under oath Monday in a...

-

Politics

Jill Biden ex-husband Questioned ahead Durst Grand Jury

Just since Wednesday afternoon, the long-running Robert Durst murder has taken an intriguing turn. According to...

-

Politics